4 November 2022 – SAVANT, the unique geo-spatial analytics product launched in October 2019 by Earth-i and Marex, covers global smelting activity for both Copper and Nickel.

- Copper Inactive Capacity in Asia & Oceania jumped to 19.0 from only 5.9 in September

- Continued weakness in NPI smelting activity in China

- Nickel smelting activity remains weak in Europe & Africa

“…recessionary fears have permeated metals markets and volumes have dissipated…”

October 2022 Copper observations include:

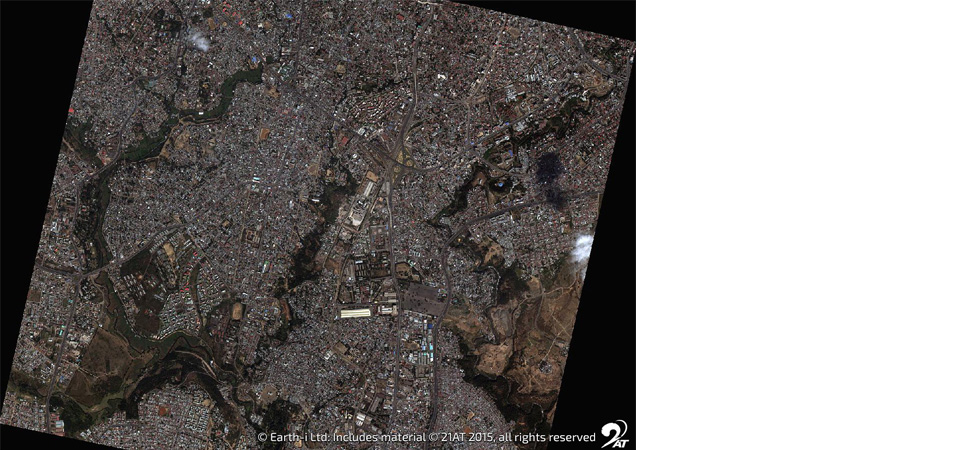

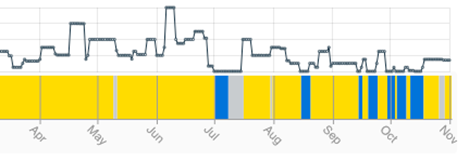

Global smelting activity fell in October as all regions, barring North America, saw declines. The Global Activity Dispersion Index has now been below the average of 50 for eight consecutive months, indicative not only of a year that has been heavy in major maintenance scheduling, but also of expectations of rising concentrate availability into the final quarter. However even with treatment and refining charges (TC/RC) in the mid $80/s, smelter output remains underwhelming, in part due to performance issues. The most significant recent disruption has been at the Zhezkazgan smelter in Kazakhstan where activity has been intermittent since the middle of September, contributing to a rise in the Asia & Oceania Inactive Capacity Index. Meanwhile in China, tightness in scrap supply also appears to be weighing on smelter utilisation rates. While full outages like those observed at Yuguang and Fangyuan in Shandong province are the exception as state-run operators eye year-end production targets, nevertheless the country level Activity Dispersion Index continues to fall. Otherwise, it was notable that we saw the first indications of commissioning at Daye’s Hongsheng Copper project in the final week of the month.

- Global Dispersion Index fell to 47.5, down from 49.0 in September

- North America was the only region to see an increase in smelting activity over the month, rising from 26.6 in September to 43.2

- Inactive Capacity in Asia & Oceania jumped to 19.0 from only 5.9 in September. Despite this the region remains the only one to record an above average Activity Dispersion Index in October

- The China Dispersion Index fell for the fifth consecutive month to 44.3 despite the country level Inactive Capacity Index remaining in single digits at only 5.7

Sign-up here for a trial of the SAVANT service.

October 2022 Nickel observations include:

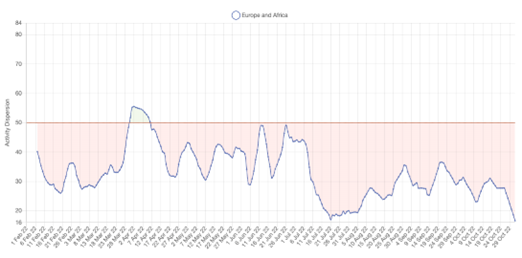

The Global Dispersion Index fell in October to 45.4, in large part due to continuing weakness in NPI smelting activity in China where the country level index fell to 40.6. 13 of the country’s 31 NPI plants were observed as inactive at the end of the month as stainless steel demand remains weak. Meanwhile in Europe, nearly two thirds of capacity is now seen as inactive due to a combination of a recessionary macroeconomic environment, deep discounts for ferronickel compared to class 1 metal and prohibitively high electricity costs. Indications are that the Kavadarci, LARCO and NewCo Ferronikeli plants have all been shuttered since the summer, while the Pobuzhskiy plant in the Ukraine has only been operating intermittently, likely due to disruptions to imported raw material feedstock. Elsewhere it was interesting to note the first activity since January at the Tagaung Taung ferronickel smelter in Myanmar – when resistance fighters were reported to have blown up three electricity pylons supplying power to the plant – contributing to the broader rise in the ferronickel grade Activity Dispersion Index.

- Global Dispersion Index fell back to 45.4 from 51.3 in September

- The NPI Dispersion Index in China fell for the fifth consecutive month to 40.6 as the Inactive Capacity series rose to 26.7 from 23.0 in September

- Smelting activity remains weak in Europe & Africa as the Activity Dispersion index fell back to only 25.8 – the lowest monthly average since July – finishing October at only 14.4

- Of the nickel grades, ferronickel was the only one to register an increase in October, with the Activity Dispersion Index rising to 42.4 from 37.6 in September

Sign-up here for a trial of the SAVANT service.

Dr Guy Wolf, Marex Global Head of Analytics, commented: “Falling SAVANT global smelting activity series mirror the mood during LME Week, where recessionary fears have permeated metals markets and volumes have dissipated. Lower turnover is a natural consequence of bear markets in derivatives, as is lower output through the supply chain in the physical marketplace. The Fed’s warning that interest rates will peak at a higher terminal level than previously expected will do little to alleviate pressure on both.”

Zhezkazgan Copper Smelter Activity (yellow = active, blue = inactive), Mar 2022 – Present

Europe & Africa Nickel Dispersion Index, Feb 2022 – Present (weekly average)

The Activity Dispersion Index is a measure of capacity-weighted activity levels observed at smelter sites where a reading of 50 indicates that current activity levels are at average levels. Readings above or below 50 indicate greater or lesser activity levels than average, respectively. The above chart displays these readings as a weekly rolling average.

The Inactive Capacity Index is derived from binary observations of a smelter’s operational status as being either active or inactive. The capacity weighted global and regional indices show the percentage of smelter capacity that is inactive, with readings displayed in the chart below as a weekly rolling average. A reading of zero would indicate 100% smelting capacity.

The SAVANT platform monitors up to 90% of the smelting capacity for copper and nickel round the globe. Using daily updated sources, including extensive use of geospatial data collected from satellites, the index reports on the activities at the world’s smelting plants offering subscribers unprecedented levels of coverage, accuracy and reliability. This dataset allows users to make better informed and more timely trading decisions.

Sign-up here for a trial of the SAVANT service.

About Earth-i

Earth-i is a geospatial intelligence company using machine learning, artificial intelligence and Earth Observation data to provide unique and relevant insights, derived from diverse geospatial data, that deliver clear decision advantage for businesses, governments and other organisations.

Earth-i provides advanced analytics using automated interpretation of a range of geospatial Earth Observation data sources including colour imagery, colour video, infra-red and radar from a range of sources including satellite, drone, aerial and ground-based sensors. This data is fused with additional data sources to extract factual understanding and generate predictive insights across a range of markets such as commodities, supply chain, agriculture, infrastructure and defence.

For more information visit:

Website: www.earthi.space

Twitter: @Earthi_

LinkedIn: Earth-i

About Marex

Marex is a diversified global financial services platform, providing essential liquidity, market access and infrastructure services to clients in the energy, commodities and financial markets.

The Group provides comprehensive breadth and depth of coverage across five core services: Market Making, Execution and Clearing, Hedging and Investment Solutions, Price Discovery and Data & Advisory. It has a leading franchise in many major metals, energy and agricultural products, executing around 38 million trades and clearing over 193 million contracts in 2021. The Group provides access to the world’s major commodity markets, covering a broad range of clients that include some of the largest commodity producers, consumers and traders, banks, hedge funds and asset managers.

Marex was established in 2005 but through its subsidiaries can trace its roots in the commodity markets back almost 100 years. Headquartered in London with 22 offices worldwide, the Group has over 1,300 employees across Europe, Asia and America.

For more information visit www.marex.com