2 March 2023 – SAVANT, the unique geo-spatial analytics product launched in October 2019 by Earth-i and Marex, covers global smelting activity for both Copper and Nickel.

– China copper and nickel data is very strong, aligning with PMI figures–

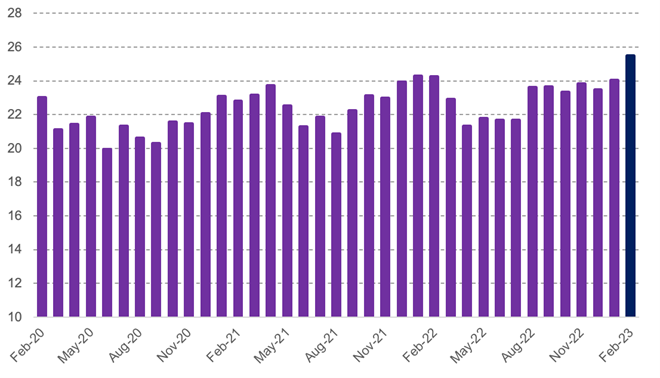

– China copper smelter production records highest per day output at 25.5kt/day –

– All China regions record copper dispersion readings above 50 –

– Shuttered ferronickel operations in S Europe drags down global index –

– Global copper and nickel inactive indices at recent lows –

February 2023 Copper observations include:

The Global Dispersion Index fell back below the average of 50 in February to 49.5. This was primarily due to a deterioration in operating conditions in Africa, where a combination of ownership disputes and challenging logistics for inbound supplies have seen three of the continent’s seven smelters inactive for extended periods in recent months. In addition, following a 17-day shutdown in December to repair a water leak in the off-gas system, the Tsumeb smelter in Namibia appears to be operating below capacity as the owners continue to take remedial actions. In contrast, activity in China was very strong where all of the country’s regions recorded an Activity Dispersion above 50. Indeed, country level Smelter Production recorded its highest average on record at 25.5kt/day, presaging the release on Wednesday of China’s strongest Manufacturing PMI in more than a decade at 52.6. At the end of the month, all 37 smelters monitored by SAVANT were observed active so that the country level Dispersion Index had risen to 59.4, its highest single day reading in 8 months.

- Global Dispersion Index fell to 49.5 in February from 50.1 in January, despite the Global Inactive Capacity Index registering a 12-month low at 7.7%

- This dichotomy was the result of strong activity at a large number of smelters in China, where the country-level Dispersion Index rose by 3.9 points to 52.6, offset by weakness in Africa concentrated at a smaller number of sites, where the continental Dispersion Index fell 10.9 points to 41.6

- All regions in China recorded Dispersion Index readings above 50 for the month of February, as country level Smelter Production recorded its highest per day output on record at 25.5kt/day

- Custom and captive smelting activity diverged with the former rising to 50.5 from 47.7 in January and the latter falling from 52.9 to 48.3 in February

Sign-up here for a trial of the SAVANT service or read the Nasdaq report card on Savant here: MGST Report Card.

February 2023 Nickel observations include:

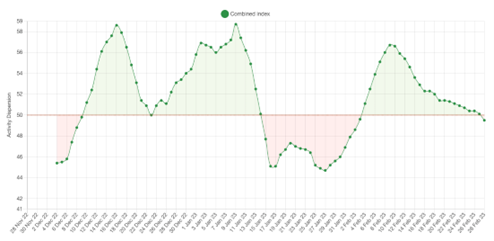

The Global Dispersion Index fell in February to 49.1, despite a fall in the Global Inactive Capacity to 10.8%, its lowest reading since May 2021. In the last three of four months, both China and Indonesia NPI have recorded Activity Dispersion readings above 50 as production rises to meet demand from the stainless steel sector, where global output this year is forecast to reach 60 million tonnes. A relatively strong fourth quarter has fueled expectations of stimulus-led demand in China as well as downstream restocking in Europe, where recent declines in energy costs have restored some confidence in the outlook for the year, despite subdued market conditions at present. Instead, it is weakness in class 1 and ferronickel production that is dragging down the global series as ferronickel operations in southern Europe remain shuttered, while the FeNix smelter in Guatemala appears to still be experiencing constraints following disputes with authorities and local communities that started last year.

- Global Dispersion Index fell back to 49.1 in February from 49.4 in January

- Global Inactive Capacity reading fell to 10.8%, the fifth consecutive fall and the lowest reading since May 2021

- The China NPI Dispersion Index rose back above 50, gaining 5.4 points from January to 51.7

- The Indonesia NPI Dispersion Index recorded its lowest ever Inactive Capacity reading at 2.8%, while the Activity Dispersion Index rose to 53.1, its fourth consecutive month above the 2 year average of 50

Sign-up here for a trial of the SAVANT service or read the Nasdaq report card on Savant here: MGST Report Card.

Dr Guy Wolf, Marex Global Head of Analytics, commented: “Over the last three weeks, we have been pointing out to clients how strongly smelter production in China was tracking, so while this week’s manufacturing PMI might have come as a surprise to many, SAVANT data had already given them plenty of time to position for the news.”

China Smelter Production (kt/day), February 2020 – Present

China & Indonesia NPI Activity Dispersion (combined), November 2022 – Present

The Smelter Production series is a set of indices derived from capacity-weighted activity levels observed at smelter sites and collated to country and regional levels. Readings are displayed on a kilotonnes of production basis for the monthly, quarterly and annual periods.

The Activity Dispersion Index is a measure of capacity-weighted activity levels observed at smelter sites where a reading of 50 indicates that current activity levels are at average levels. Readings above or below 50 indicate greater or lesser activity levels than average, respectively. The above chart displays these readings as a weekly rolling average.

The Inactive Capacity Index is derived from binary observations of a smelter’s operational status as being either active or inactive. The capacity weighted global and regional indices show the percentage of smelter capacity that is inactive, with readings displayed in the chart below as a weekly rolling average. A reading of zero would indicate 100% smelting capacity.

The SAVANT platform monitors up to 90% of the smelting capacity for copper and nickel round the globe. Using daily updated sources, including extensive use of geospatial data collected from satellites, the index reports on the activities at the world’s smelting plants offering subscribers unprecedented levels of coverage, accuracy and reliability. This dataset allows users to make better informed and more timely trading decisions.

Sign-up here for a trial of the SAVANT service or read the Nasdaq report card on Savant here: MGST Report Card.

About Earth-i

Earth-i is a geospatial intelligence company using machine learning, artificial intelligence and Earth Observation data to provide unique and relevant insights, derived from diverse geospatial data, that deliver clear decision advantage for businesses, governments and other organisations.

Earth-i provides advanced analytics using automated interpretation of a range of geospatial Earth Observation data sources including colour imagery, colour video, infra-red and radar from a range of sources including satellite, drone, aerial and ground-based sensors. This data is fused with additional data sources to extract factual understanding and generate predictive insights across a range of markets such as commodities, supply chain, agriculture, infrastructure and defence.

For more information visit:

Website: www.earthi.space

Twitter: @Earthi_

LinkedIn: Earth-i

About Marex

Marex is a diversified global financial services platform, providing essential liquidity, market access and infrastructure services to clients in the energy, commodities and financial markets.

The Group provides comprehensive breadth and depth of coverage across five core services: Market Making, Execution and Clearing, Hedging and Investment Solutions, Price Discovery and Data & Advisory. It has a leading franchise in many major metals, energy and agricultural products, executing around 38 million trades and clearing over 193 million contracts in 2021. The Group provides access to the world’s major commodity markets, covering a broad range of clients that include some of the largest commodity producers, consumers and traders, banks, hedge funds and asset managers.

Marex was established in 2005 but through its subsidiaries can trace its roots in the commodity markets back almost 100 years. Headquartered in London with 22 offices worldwide, the Group has over 1,300 employees across Europe, Asia and America.

For more information visit www.marex.com