17 November 2024 – London – If you ask physical traders of copper which assets they have the least visibility of, they will more likely than not point to Central Asia and the landlocked smelters of Kazakhstan, Uzbekistan and the Ural Mountains. As these plants have for the most part been too remote to participate in the global trade in concentrates, they have largely been left to their own devices, often overlooked by analysts when examining trade flows. However, with the redrawing of the geopolitical map in recent years their importance has become ever more apparent, while at the same time their obscurity has increased now that Russia no longer reports trade data.

Remoteness has meant that, for western market participants, it has often been difficult to gather market intelligence using traditional data sources. Of course, the ascension of satellite monitoring has changed this, with their operating signatures as accessible as any others on the planet. So now with Asia Copper Week upon us and the start of negotiations for refined metal premiums in the region, we thought the time was right to highlight the unique insights that SAVANT can provide in relation to this cohort of significant, but opaque, operations.

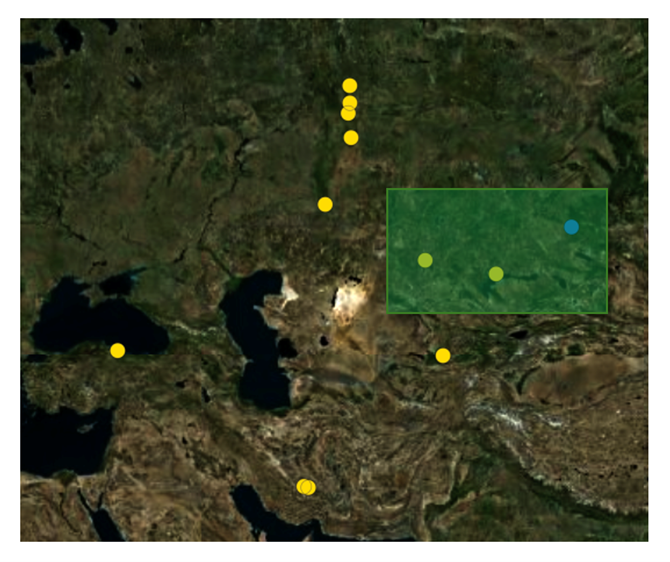

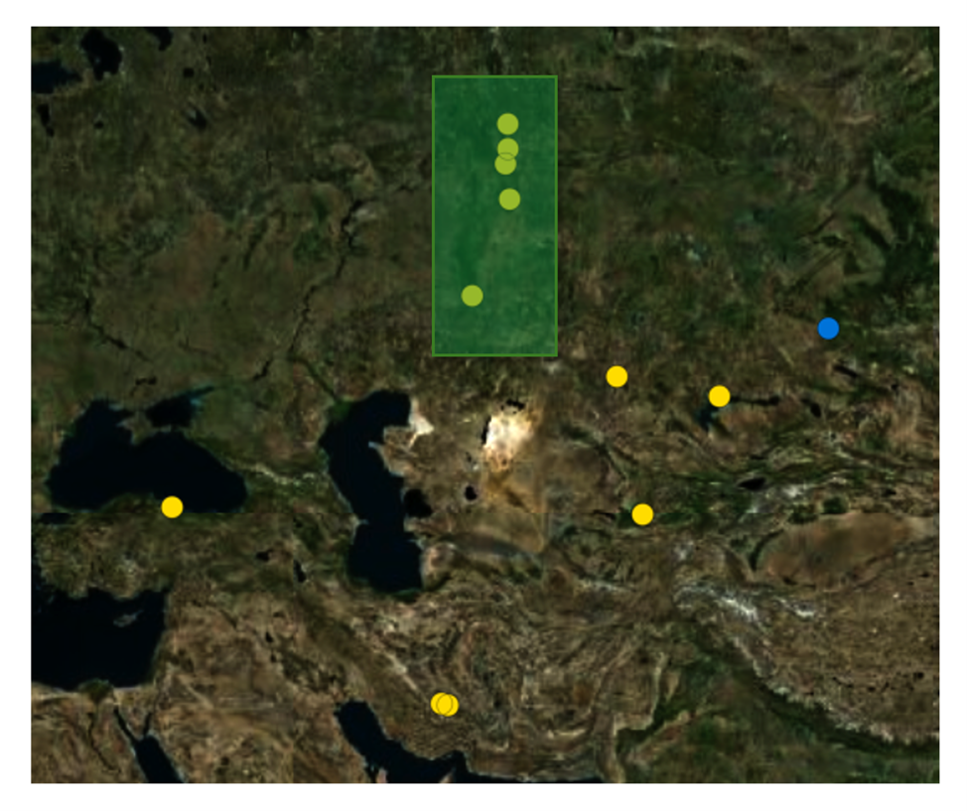

Image 1: SAVANT copper smelters in Kazakhstan

AAt ~490 kt/a, Kazakhstan possesses the 11th largest total smelting capacity under SAVANT coverage. This is split between the Balkash (220 kt/a) and Zhezkazgan (200 kt/a) facilities operated by Kazakhmys (not to be confused with KAZ Minerals that owns the Bozshakol and Aktogay mines in the country) and Glencore’s Ust-Kamenogorsk (70 kt/a) smelter. As Kazakhmys is a private company – owned by the country’s richest individual, Vladimir Kim – operating data is not publicly available, so that production estimates are something of a guessing game. However for users of the SAVANT platform, operating activity is readily apparent. Indeed, back in the middle of 2018 it was obvious that major changes were taking place at the site, with confirmation received afterwards that the second furnace, which had been shuttered since 2009, was being recommissioned.

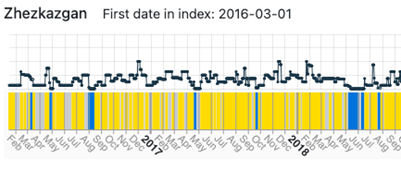

Chart 1: SAVANT inactivity profile, Zhezkazgan, 2016- 2018 (yellow = active, blue = inactive)

Now the Kazakhstan Government and China Nonferrous Metals Mining Group (CNMC) have entered an agreement to build a new 300 kt/a smelter near Aktogay village, at a cost of $1.5 Bn. With production from Aktogay forecast at 195 – 215 kt/a of copper in concentrates this year and with a further 100 kt/a from Bozshakol, there is certainly the local copper output to justify such a plant. Indeed, at present concentrates from these mines are for the most part railed to China, with only small quantities toll treated in-country.

Kazakhstan is therefore set to become a major player in the global copper smelting industry and with capacity of almost 800 kt/a, the country would leap to 6th place in SAVANT coverage behind only China, Chile, Japan, Russia and Zambia.

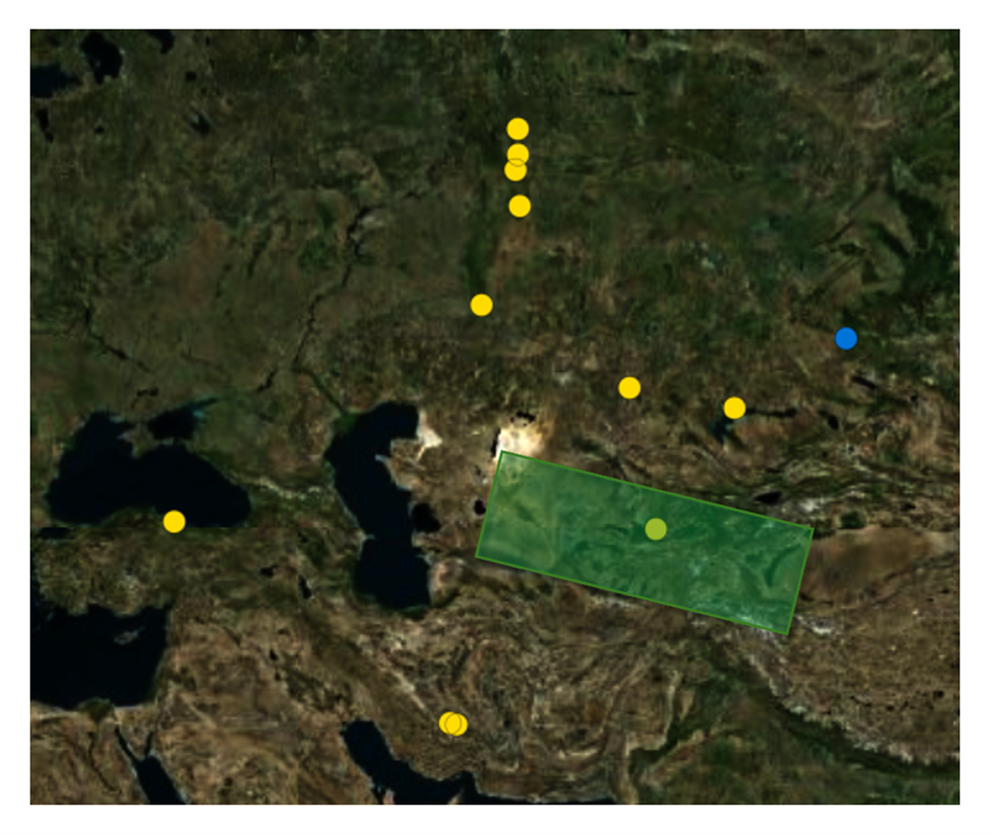

Image 2: Smelter in Uzbekistan

The state-controlled Almalyk Mining and Metallurgical Combine’s (Almalyk MMC) eponymous 150 kt/a smelter is the country’s sole production plant … for now. Taking copper-molybdenum ores from the Khondiza, Kalmokgyr and Sari-chokki mines, the captive smelter has had a very stable operating history, showing almost uninterrupted operating activity for the last two years:

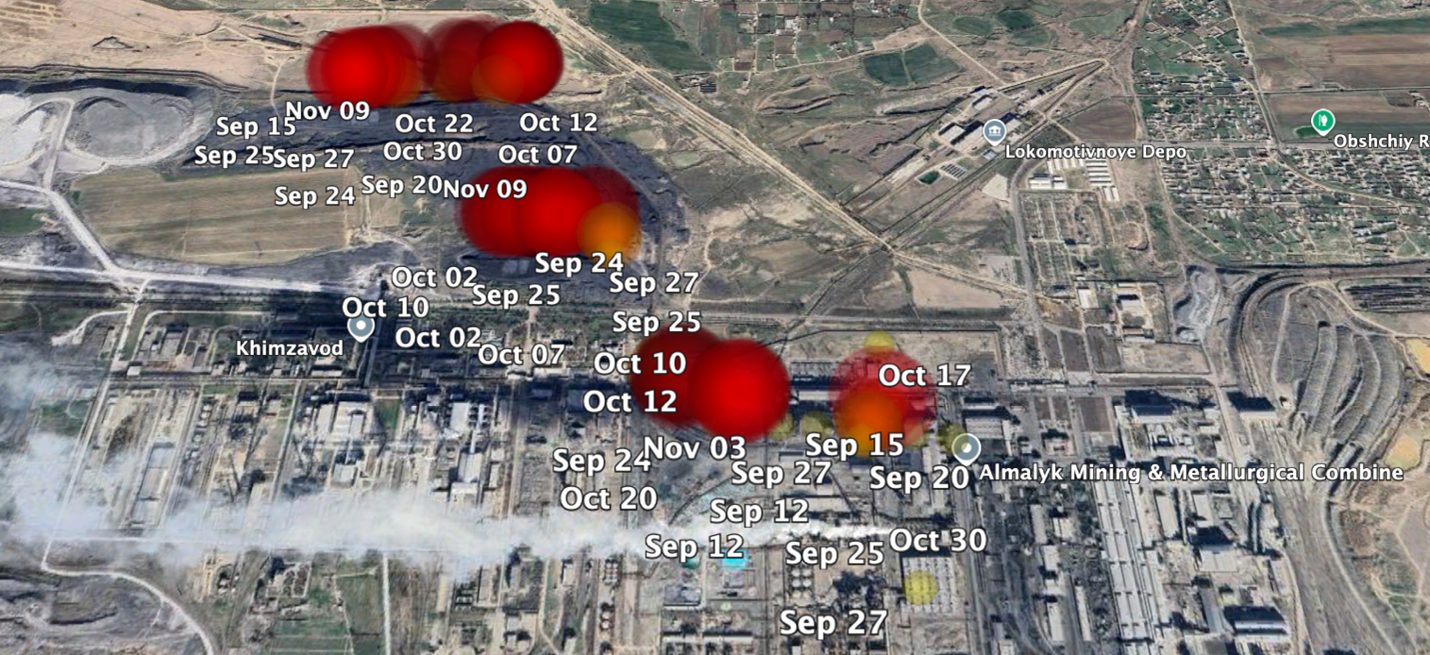

Chart 2: SAVANT inactivity profile, Almalyk, 2023 -Present (yellow = active, blue = inactive)

Chart 3: SAVANT inactivity profile, Almalyk, 2023 -Present (yellow = active, blue = inactive)

Additionally the company signed a frame agreement with Metso earlier this year for the construction of a new 300 kt/a smelter at the site, that when operational would see Uzbekistan jump seven places to 12th in SAVANT’s coverage. Simultaneously, Almalyk MMC also announced plans to spend $15 Bn on an expansion program that would see upstream production capacity rise to ~400 kt/a by 2030.

Image 3: Smelters in the Ural Mountains

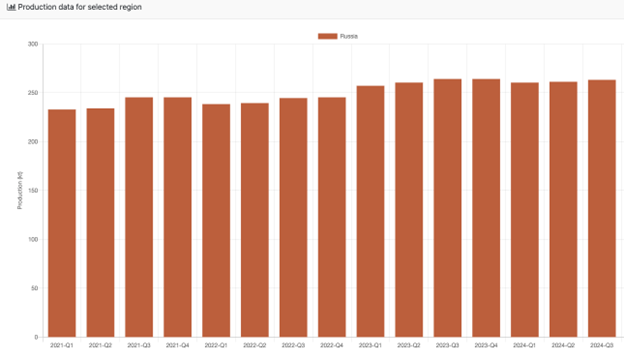

With four smelters totaling almost ~400 kt/a capacity under coverage by SAVANT, Ural Mining and Metallurgical Company (UMMC) used to have two brands that were deliverable onto the LME, being UMMC and UMMC II, so that a good proportion of output headed west to Europe. But since the imposition of sanctions in 2022 against founder and former president Iskander Makhmudov, updated in April this year to prevent the delivery of fresh metal onto the LME and CME exchanges, production from the company’s plants appear to have been diverted eastwards. The same can be said for metal from Russian Copper Company’s 230 kt/a Karabashmed smelter. Although this is not the only route available – with plenty of semis manufacturers in Turkey and the Middle East, metal from the Urals can be shipped south and converted to midstream products before on-sale.

Indeed shifting trade flows were a precursor to news in the summer that Nornickel was in discussions with China Copper regarding the possible relocation of its smelting capacity away from the company’s traditional headquarters in the Arctic Circle, to China. Rising production at a country level in SAVANT’s production beta would seem to indicate that despite the displacement of over 200,000 tonnes of copper due to the imposition of sanctions, Russian producers are not struggling to sell their metal, whether this is at home to support the war or in international markets.

Chart 4: SAVANT production beta (kt copper), Russia (quarterly 2021 – 2024)

In conclusion, it looks as if the world’s most opaque region in terms of copper production is set to assume an expanded role in the industry, further complicating trade flows that have been turned on their head in the last 3 years following the war in Ukraine. At the same time the region is also going to become a much larger net exporter of copper metal, increasing its influence on regional premia given its location between Europe and China.

Traders might be tempted to set up an office in Astana or Tashkent. Alternatively, SAVANT will always be watching…

If you would like to find out more about SAVANT and how you can subscribe, please email savant@earthi.space or call +44 (0)333 433 0015.

About SAVANT:

Earth-i’s SAVANT platform monitors up to 95% of the smelting capacity for copper and nickel around the globe and provides indicators of smelter activity and production around the globe, in an easy-to-understand format, covering multiple metals and minerals.

Data is collected and analysed using advanced algorithms derived from Computer Vision and Machine Learning techniques. Data is taken from several different Earth Observation satellites and our global and regional indices are updated at a high frequency to give consistent, insightful and dependable results.

Activity is scientifically measured using a consistent methodology. Over eight years of historical data is available.

About Earth-i:

Earth-i is a geospatial intelligence company using machine learning, artificial intelligence and Earth Observation data to provide unique and relevant insights, derived from diverse geospatial data, that deliver clear decision advantage for businesses, governments and other organisations.

Earth-i provides advanced analytics using automated interpretation of a range of geospatial Earth Observation data sources including colour imagery, colour video, infra-red and radar from a range of sources including satellite, drone, aerial and ground-based sensors. This data is fused with additional data sources to extract factual understanding and generate predictive insights across a range of markets such as commodities, supply chain, agriculture, infrastructure and defence.

#CopperProduction #CopperSmelting #CriticalMaterials