12 December 2024 – London – It is no exaggeration to say the news at the end of last week that Antofagasta and Jiangxi Copper had agreed treatment and refining charges (‘TC/RCs‘) for 2025 at $21.25/2.125 rocked the industry.

Most participants had been expecting a number in the 30s, which would still have been a record low, but a figure in the low 20s speaks to the seismic shift in the balance of power between miners and processors.

While it is likely that the US’s interest in defending globalisation will diminish with the incoming Trump administration, the copper smelting industry was already entering a post-global world due to a combination of economic upgrading, re-shoring and localisation, so that recent investments in capacity will profoundly alter the global map.

Economic upgrading

Image 1: SAVANT smelters in Indonesia

Since the turn of the millennium, the vast majority of new smelting capacity has been built in China. This was a familiar story of outsourcing (dirty) processing to a lower cost jurisdiction, delivering a pareto efficient outcome for all parties. However by the middle of the first decade of the new century the notion of ‘downstreaming’ had emerged, especially in Indonesia, so that President Yudhoyono signed a regulation banning the export of unprocessed nickel and bauxite ores in 2014. President Widodo would double down on his predecessor’s commitment, including copper as well.

This put miners such as Freeport McMoRan (Freeport), who operate the world’s largest mine in the eastern hemisphere at Grasberg in Central Papua, in a bind – the economics of constructing a smelter simply did not stack up compared to the relatively small uplift in revenues from the TC/RC and other by-product streams. Nevertheless and despite the protestations of Freeport’s then CEO and now Chair Richard Adkerson, the North American miner was effectively forced into building a $3.7 Bn smelter at Manyar to process the additional concentrate from the mine that was not already going to the neighbouring Gresik plant. Similarly, Amman Minerals have also built a 220 Kt/a smelter in West Nusa Tenggara to process material from the company’s Batu Hijau mine.

Although a fire at the acid plant that broke out in October has delayed ramp up at Manyar (see real-time footage in this clip), it appears that Freeport are still in negotiations with the Indonesian government over an extension to their concentrates export permit beyond the end of this year. Grasberg concentrates have traditionally been exported to smelters in Japan, Korea and India rather than China due to their high gold content, as well as being sent to the company’s 320 Kt/a plant at Huelva in Spain. But from 2025 the likely displacement of all Indonesian concentrates from the international market will force these facilities to either take equity tonnes from other mines within their upstream portfolio, buy concentrates in the market at unattractive TC/RCs, or become higher cost operations at lower capacity utilisation.

Reshoring

Image 2: SAVANT secondary smelters in North America

If globalisation conferred the benefits of lower prices and increased efficiency, many are now realising that this came at the cost of supply chain security (as well as ESG). An overreliance on any one counterpart is risky, especially if that jurisdiction is ideologically opposed to your own. Add to this the decarbonisation imperative, so that countries must compete for scarce resources of raw materials, and it is logical that recycling should play a significant role in the industry’s future, especially in the advanced economies of the North Atlantic that have been areas of traditional strength in copper demand. Companies like Wieland and Aurubis identified the opportunity in the US, even before the threat of an escalating tariff war with China that will likely increase the availability of domestically available secondary copper units. Their new plants at Shelbyville and Richmond respectively will supplement existing North American processing capacity at Ames’ Shelby in North Carolina and Glencore’s Horne in Canada, while in Europe Aurubis already have facilities at Beerse and Lunen under SAVANT coverage.

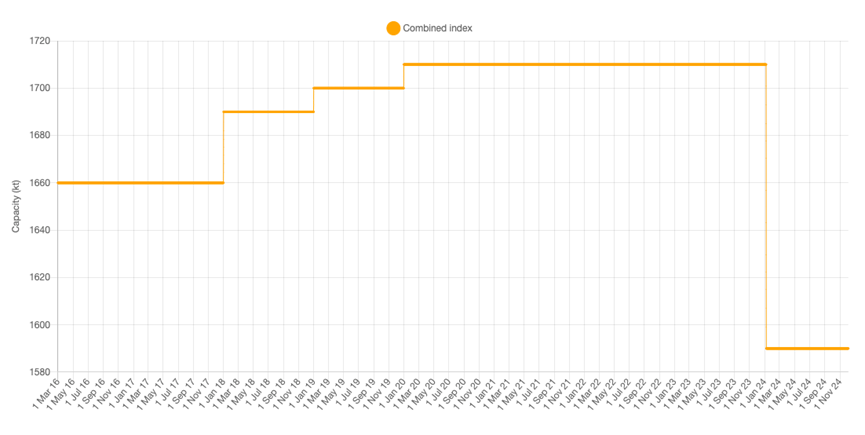

And reshoring is unlikely to be limited to recycling. Indeed, the Chilean government under Gabriel Boric has been looking for partners for a new smelting project in the country since last year. Following the recent closures of both the Las Ventanas and Hernan Videla Lira smelters, available smelting capacity at the SAVANT country index level has fallen to only just over 1.5 Mt, such that over 50% of concentrates from the world’s largest copper miner are now exported overseas for processing. Subsequently the status quo presents a significant risk to the country’s Treasury coffers, where copper accounts for 90% of the Chile’s total mining exports. So while TC/RCs may remain low for the rest of the decade as new smelting capacity coming online outweighs that of additional mine output, the longer-term strategic value of increased control of the supply chain would seem a higher priority for the government.

Chart 1: Chilean smelting capacity under SAVANT coverage, 2017 – Present

Chart 2: SAVANT inactivity profiles, selected Chilean smelters

Localisation

Image 3: SAVANT new smelters in India and Saudi Arabia

Finally, the development of new processing facilities in emerging markets that are expected to see strong growth in copper demand ties together many of the themes already mentioned. Analysts have been perennially disappointed by the failure of copper demand in India to live up to potential. However with the International Copper Association India expecting consumption growth to come in at 13% for 2024 at 1.7 Mt, it appears that the time is ripe as strength in the construction and infrastructure sectors will most likely endure, linked to the country’s overall economic expansion.

India’s growing import reliance for a key critical mineral had not gone unnoticed. Therefore not only will Adani’s new 500 Kt/a Kutch smelter allow in-country processing of increasing equity tonnes from upstream investments by Indian companies overseas, but also to recycle a growing percentage of the 468,000 tonnes of end-of-life copper and alloy scrap generated this year. Crucially, by remelting these scraps at the smelter stage rather than as direct melt at semi fabricators, the quality of the metal in second use is also improved, with the better purity achieved enabling its use in the applications necessary for clean energy technologies.

Similarly, in Saudi Arabia plans for a new 400 Kt/a smelter/refinery at Ras Al Khair, to be built and operated by Indian company Vedanta, speaks to the growing demand profile of the region as a whole. As Saudi Arabia seeks to become a modern industrial hub, the energy demands of automation could increase copper wire and cable transmission requirements significantly.

Conclusion

Of all countries, China is probably best positioned for the post-global world with significant reach upstream through its investments in Africa, South America, Asia and into Europe. However with a combination of forces ensuring that other governments are willing to support copper smelting projects at home rather than rely on imports, a period of rationalisation looks imminent, especially if the terms agreed between Antofagasta and Jiangxi Copper become the benchmark. To our mind, the smelters that are most likely to come under pressure are those in locations with high energy costs as well as being remote from regions of strong demand growth and/or access to scrap.

If you would like to find out more the Copper sites above, or about SAVANT and how you can subscribe, please email savant@earthi.space or call +44 (0)333 433 0015.

About SAVANT:

Earth-i’s SAVANT platform monitors up to 95% of the smelting capacity for copper and nickel around the globe and provides indicators of smelter activity and production around the globe, in an easy-to-understand format, covering multiple metals and minerals.

Data is collected and analysed using advanced algorithms derived from Computer Vision and Machine Learning techniques. Data is taken from several different Earth Observation satellites and our global and regional indices are updated at a high frequency to give consistent, insightful and dependable results.

Activity is scientifically measured using a consistent methodology. Over eight years of historical data is available.

About Earth-i:

Earth-i is a geospatial intelligence company using machine learning, artificial intelligence and Earth Observation data to provide unique and relevant insights, derived from diverse geospatial data, that deliver clear decision advantage for businesses, governments and other organisations.

Earth-i provides advanced analytics using automated interpretation of a range of geospatial Earth Observation data sources including colour imagery, colour video, infra-red and radar from a range of sources including satellite, drone, aerial and ground-based sensors. This data is fused with additional data sources to extract factual understanding and generate predictive insights across a range of markets such as commodities, supply chain, agriculture, infrastructure and defence.

#CopperProduction #CopperSmelting #CriticalMaterials