10 December 2024 – London – In a surprising reversal from October, copper smelting activity increased in November according to Earth-i‘s SAVANT real-time Global Copper Monitoring Index, with average smelter inactivity falling by 2.7% m/m to 13.4%, the lowest reading since February. Unusually the move was not driven by activity in China, home to over 40% of capacity covered by SAVANT, where activity increased by only 0.2% (as deduced by a fall in inactivity of 0.2% m/m to 15.3%). Instead, the move was led by gains in all other regions, South America being the exception where inactivity remained steady at 16.5%. Excluding ‘maintenance season’ in China (the months of April and May), Rest of World smelting activity was higher than in China for the first time since January 2023.

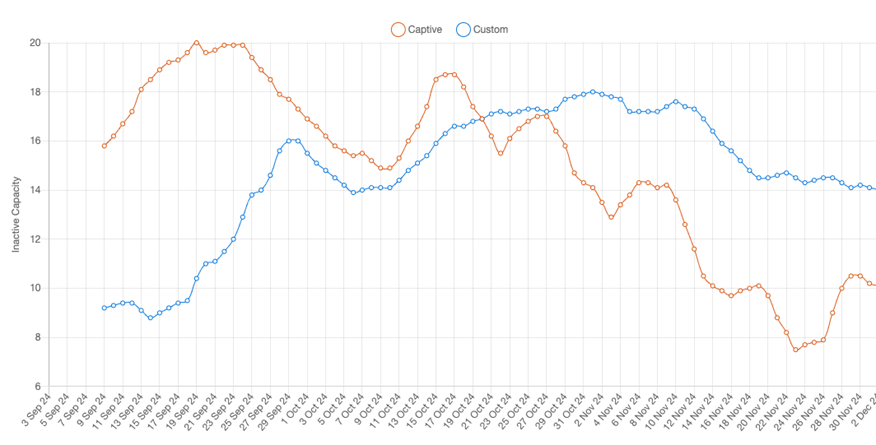

Driving the divergence at a regional level were differing behaviours between smelter types which are classified as either ‘custom’, whereby they purchase their concentrate feed from third parties, or ‘captive’ plants that are part of an integrated supply chain, usually co-located with a large mining complex. In November inactivity at captive smelters fell sharply, by 5.3% m/m, to 10.7%. By contrast, inactivity at custom smelters declined by only 0.7% m/m to 15.5%.

Fig I: Inactivity at global custom and captive smelters, Sep – Nov 2024

It is no surprise that this mirrors activity at a regional level as over 50% of all operating custom smelters under SAVANT coverage are in China, where operators are struggling with extremely low prevailing treatment and refining charges, or ‘TC/RCs‘, the fee that they get for processing concentrates to metal.

Meanwhile, the cohort of the 15 largest captive smelters globally with capacities greater 200 Kt/a performed well. An uninterrupted month at the 540 Kt/a Glogow smelter in Poland, following maintenance to line 1 in Q3, boosted Europe’s performance so that inactivity for the region fell by 8.3% m/m.

North America saw a similar decline of 8.7% m/m, helped by a strong performance from the 300 Kt/a La Caridad plant in Mexico. The continued ramp up of the 310 Kt/a Nchanga smelter boosted activity on the Mother Continent, which rose by 3.1% m/m, so that the regional inactivity index now sits at 20.9%, a full 25% below the same time last year. Inactivity in Asia and Oceania fell by 3.7% to just 3.6%, the lowest of all the regions, aided by strong performances at Norilsk, as well as the central Asian smelters of Zhezkazgan and Balkash that we recently featured in our article ‘Copper’s final frontier … Should traders boldly go to Central Asia?‘.

Fig II: Glogow smelter activity, H2 2024

Fig III: La Caridad smelter activity, 2024

Fig IV: Zhezkazgan smelter activity, H2 2024

Yellow = Active / Blue = Inactive / Grey = No reading

See more about Earth-i’s SAVANT Global Copper Monitoring Index here.

About SAVANT:

Earth-i’s SAVANT platform monitors up to 95% of the smelting capacity for copper and nickel around the globe and provides indicators of smelter activity and production around the globe, in an easy-to-understand format, covering multiple metals and minerals.

Data is collected and analysed using advanced algorithms derived from Computer Vision and Machine Learning techniques. Data is taken from several different Earth Observation satellites and our global and regional indices are updated at a high frequency to give consistent, insightful and dependable results.

Activity is scientifically measured using a consistent methodology. Over eight years of historical data is available.

About Earth-i:

Earth-i is a geospatial intelligence company using machine learning, artificial intelligence and Earth Observation data to provide unique and relevant insights, derived from diverse geospatial data, that deliver clear decision advantage for businesses, governments and other organisations.

Earth-i provides advanced analytics using automated interpretation of a range of geospatial Earth Observation data sources including colour imagery, colour video, infra-red and radar from a range of sources including satellite, drone, aerial and ground-based sensors. This data is fused with additional data sources to extract factual understanding and generate predictive insights across a range of markets such as commodities, supply chain, agriculture, infrastructure and defence.

For more information visit:

Email: savant@earthi.co.uk / Website: www.earthi.space / LinkedIn: Earth-i