13 March 2025 – London – Even those with crystal balls would have been hard pressed to predict the tumultuous start to President Trump’s second term in office. Among a growing list of outlandish executive orders, the decision to impose a 25% import tariff on aluminium and steel imports stands out as particularly incandescent. On February 25th the President then widened his assault on foreign-made metal under Section 232 of the Trade Expansion Act, directing Secretary of Commerce Lutnick to investigate the threat to national security associated with copper imports, before going to state that ‘the United States has ample copper reserves, yet our smelting and refining capacity lags significantly behind global competitors’. The executive order then singled out China for its dominant position in processing.

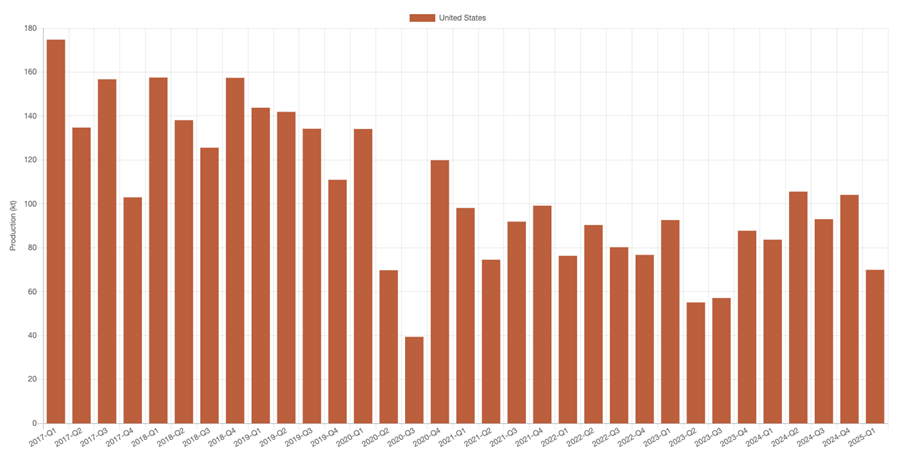

The President’s policies are of course designed to encourage the revival of the US copper industry which SAVANT monitoring shows has been in steady decline for almost a decade (see Chart 1). But as many commentators have already pointed out, the length of time it takes to discover, develop and bring a mine into operation extends well beyond his presidential term. So what is he thinking?

Chart 1: SAVANT copper production beta (kt), USA (quarterly 2017 – Present)

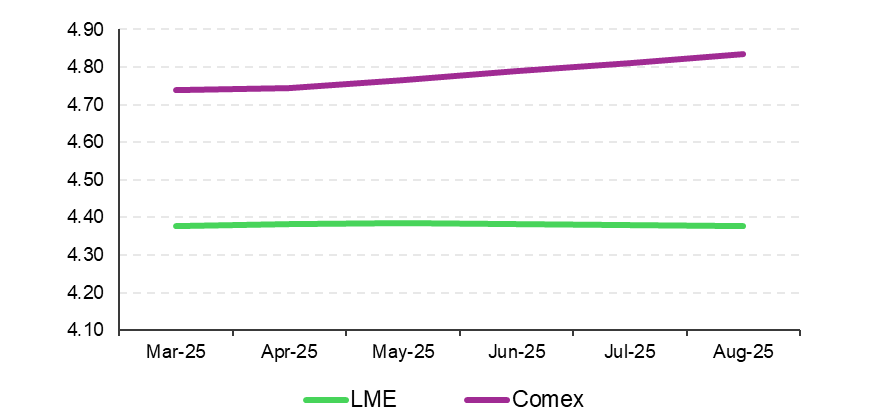

While trying to second guess Mr. Trump is an exercise in folly, there would seem to be at least one ‘quick win’ that would enable him to claim he had set America on the road to reducing the country’s reliance on foreign producers for its copper, even if making America a great of the copper industry again looks many years away. Firstly, the increase in local copper prices that has seen Comex contracts establish a structural premium to those on the LME in anticipation of the imposition of tariffs (see Chart 2), could be the fillip necessary to revive ASARCO’s 160 kT/a Hayden smelter eighty kilometers to the north-east of Tucson, Arizona.

Chart 2: Exchange closing prices ($/lb), Tuesday 11th March 2025

As copper prices rose to a peak of $5.10/lb in May last year, parent company Grupo Mexico spoke publicly of dusting off the plant that has been mothballed since 2019 (see Figure 1 for last recorded activity). And with concentrates from the nearby Ray and Mission mines currently being shipped to smelters in China, this could easily be positioned as killing two birds with one stone.

Figure 1 : Thermal hotspot imaging for the Hayden smelter, Q1 2023

Then there is the burgeoning domestic capacity in secondary smelting that we highlighted in our article ‘Copper smelting’s new paradigm’, looking to reprocess metal in a region of traditional demand strength. But recyclers would only seem to be the unintended beneficiaries of any tariffs, with the President not known for his embrace of the circular economy. So to single out smelting and refining suggests the administration might be contemplating subsidies and/or incentives for those willing to build further capacity to reduce the tonnage of concentrates being sent offshore. For context, the smelter that Freeport’s Indonesian subsidiary has recently built to take material from the company’s Grasberg mine cost $3.2 billion. On the other hand, the President may be eyeing the processing of ore previously categorised as ‘waste’, but now able to be extracted economically using new leach technologies. The Department of Energy’s Fast-41 program that was introduced in Mr. Trump’s first term could be expanded to speed up permitting for such projects, thereby avoiding fresh regulatory approvals that would be required to construct pyrometallurgical infrastructure.

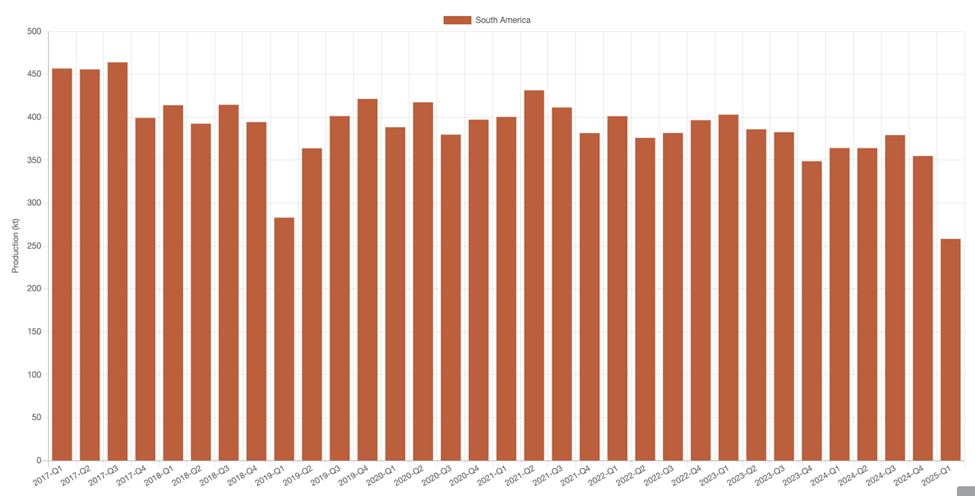

Nevertheless, in the immediacy it is difficult to see how the imposition of tariffs could reduce the perceived national security risk, particularly as it relates to China. In reality the US does not import much copper from the world’s second largest economy. Instead, the structural short in the local market that we documented back in October, between operating domestic smelter/refinery production and growing demand from the modern world’s metals intensive way of life, is largely met by imports from South America. However as SAVANT’s production series in beta shows, output here has also been falling since 2017 when quarterly smelter production averaged 444,000 t, but in 2024 could only muster 366,000 t (see Chart 3).

Chart 3: SAVANT copper production beta (kt), South America (quarterly 2017 – Present)

In addition to fewer shipments from Chile and Peru, a tariff on copper coming across the northern border from Canada would likely see trade flows diverted to Europe, or indeed facilities shut down altogether. Gary Nagle, CEO of Glencore who operate the 215 kT/a Horne plant in Quebec, recently warned ‘we’re not going to run businesses that aren’t profitable. And we are going to take action on some of our smelters around the world … when the time is right’. As a processor of complex e-waste, Horne is believed to be one of the more expensive plants on the cost curve.

So, if the tonnes aren’t going to come from South America or Canada, where will they come from? Since the start of the decade the region with the highest growth in copper production has been Africa, predominately from copper/cobalt operations via solvent-extraction electrowinning (SXEW) hydrometallurgical processing. This metal has recently been challenging the status quo in the European market and now with Comex commanding a premium to the LME, should logically find its way across the Atlantic as well. There’s just one problem for President Trump with this scenario: most of this new copper comes from Chinese-owned mines in the DRC.

The President’s grand plan might be to create a legacy for himself that sees the US copper industry rise again, maybe with the construction of a mega project like Rio Tinto (Rio) and BHP’s behemoth Resolution mine in Arizona. But here again, Mr. Trump should be reminded that Aluminium Corporation of China (Chinalco), the world’s largest producer and supplier of aluminium and a state owned enterprise (SOE), is also Rio’s largest shareholder with over 14% of the miner’s equity. Now that would seem a greater threat to national security than a few more tonnes from the Canucks.

If you would like to find out more the Copper sites above, or about SAVANT and how you can subscribe, please email savant@earthi.space or call +44 (0)333 433 0015.

About SAVANT:

Earth-i’s SAVANT platform monitors up to 95% of the smelting capacity for copper and nickel around the globe and provides indicators of smelter activity and production around the globe, in an easy-to-understand format, covering multiple metals and minerals.

Data is collected and analysed using advanced algorithms derived from Computer Vision and Machine Learning techniques. Data is taken from several different Earth Observation satellites and our global and regional indices are updated at a high frequency to give consistent, insightful and dependable results.

Activity is scientifically measured using a consistent methodology. Over eight years of historical data is available.

About Earth-i:

Earth-i is a geospatial intelligence company using machine learning, artificial intelligence and Earth Observation data to provide unique and relevant insights, derived from diverse geospatial data, that deliver clear decision advantage for businesses, governments and other organisations.

Earth-i provides advanced analytics using automated interpretation of a range of geospatial Earth Observation data sources including colour imagery, colour video, infra-red and radar from a range of sources including satellite, drone, aerial and ground-based sensors. This data is fused with additional data sources to extract factual understanding and generate predictive insights across a range of markets such as commodities, supply chain, agriculture, infrastructure and defence.

#CopperProduction #CopperSmelting #CriticalMaterials