A tumultuous start to the year – should we have imagined it could be anything else?! But while tariffs are the talk of the refined copper market, for smelters it is the downward spiral in copper treatment and refining charges (‘TC/RCs’) that is more damaging. These are now deep in negative territory, a perverse situation whereby spot pricing implies that smelters are paying for the privilege to process concentrates. Of course this is unsustainable for any length of time, so now seems an appropriate moment to take a look at those smelters that are generating headlines in the current market:

Isabel Leyte (Pasar)

The first domino to fall, Glencore have put their 330 kT/a Isabel Leyte smelter in the Philippines on care and maintenance, with the SAVANT platform registering the final activity signal on March 15th. While the plant on Leyte Island has been in the Glencore portfolio, it has largely relied on concentrates from South America and Australia. But with copper production from the latter having fallen in recent years, despite the miner/trader retaining the concentrate marketing rights to the CSA and Ernest Henry mines that it has sold to Metals Acquisition Corp and Evolution respectively, it would appear there just isn’t the volume of material available to support two smelters in the Asia Pacific region (see Mount Isa below). So despite SAVANT observations indicating that the facility had been running at a high utilisation in H2 2024 following maintenance in June-July, even economies of scale appear not to have been enough to save it from becoming the first smelter to close citing market conditions since Furukawa’s Port Kembla in 2003.

Verdict: closed indefinitely (pending new ownership?)

Altonorte

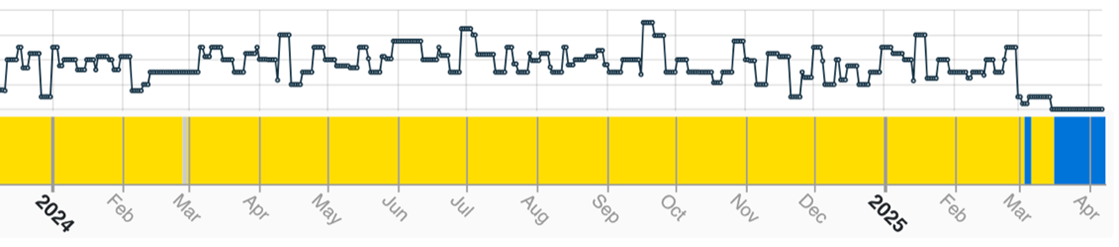

Yellow = active, blue = inactive

Reports emerged earlier in the month that Glencore has declared force majeure at its 310 kT/a Altonorte smelter in Chile, following issues affecting the furnace. As SAVANT activity signals show, the plant has now been inactive for over 3 weeks. However Altonorte is a well located plant in the Antofagasta region of Chile, close to a number of large mines including Codelco’s Chuquicamata and Radomiro Tomic. In addition, the smelter also takes feed from Glencore’s JV mine with Anglo American at Collahuasi, such that it should not be classified as a fully ‘custom’ smelter.

Verdict: offline, but likely only temporarily

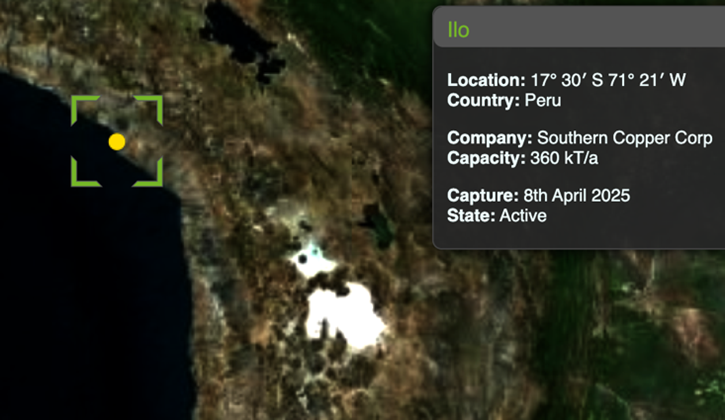

Ilo

Southern Copper’s Ilo smelter in the Moquegua region had just been given approval from the Peruvian government’s environmental certification service to start with a $62 million upgrade – a precursor to a $1.3 billion overhaul of the site that would nearly double existing processing capacity. However news last week that production at the 360 kt/a plant had been suspended due to supply issues came as a shock, as it was assumed that the plant takes much of its raw material supply from the company’s Cuajone and Toquepala mines. With feed under long-term contracts – i.e. those linked to the annual benchmark set between Antofagasta and Jiangxi Copper at $21.5/t – reportedly reduced to zero, it feels as if the plant operators may have misread the market, believing that terms would rebound to levels that would allow them to profitably take spot volumes.

Verdict: The SCC Board’s recent approval of the $1.4 billion, 120 kt Tia Maria project in the neighbouring Arequipa region was meant to supplement output of ~150 kt and ~200 kt respectively from Cuajone and Toquepala. A revamped smelter at Ilo should therefore provide significant strategic benefits by the end of the decade. A period of pain – and maybe a change of management – might be in order before then.

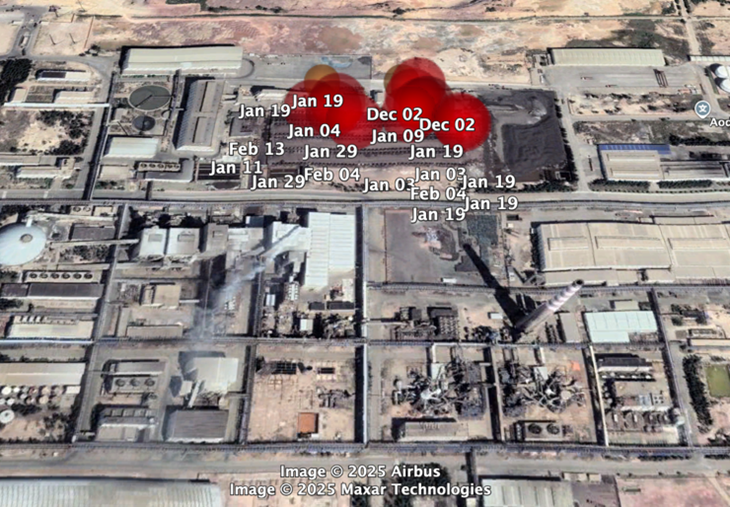

Jinchuan Fangchenggang

Trafigura’s JV with Jinchuan Group has flown under the radar …. until now. SAVANT monitoring shows that the plant has recently been inactive, starting from March 20th. Admittedly this comes at a time when some other groups are bringing forward ‘maintenance season’ programs to alleviate the pressure from prevailing market conditions, however Fangchenggang has not been one of those for which this has been flagged. This renders the recent outage something of a peculiarity … begging the question, is the smelter one of the struggling assets that Trafigura CEO Richard Holtum was referring to when he said recently ‘there are no sacred cows here’ in announcing a strategic review of the company’s processing operations across copper, lead and zinc?

Verdict: As a State Owned Enterprise (SOE), Jinchuan have an implicit ‘put’ from the Chinese government so that the recent outage was probably just for maintenance, albeit unannounced.

Horne

It looks like the imposition of tariffs might have been the straw that broke the camel’s back for Glencore’s executive when it comes to the Horne smelter in Quebec. As we flagged in our last feature article ‘Would tariffs revive the US copper industry?‘, CEO Gary Nagle had warned that he would act ‘when the time is right’ to tackle a lack of profitability at some of the miner/ traders smelting assets … and with the imposition of tariffs on Canadian copper by the Trump administration in the wake of an executive order to investigate the threat to national security from copper imports, that time appears to be now. As such Horne will now be absorbed into Glencore’s zinc division as part of further cost cutting following layoffs that started in its Montreal regional office in December. For now SAVANT monitoring shows that the plant remains active, but for how long?…

Verdict: the clock is ticking

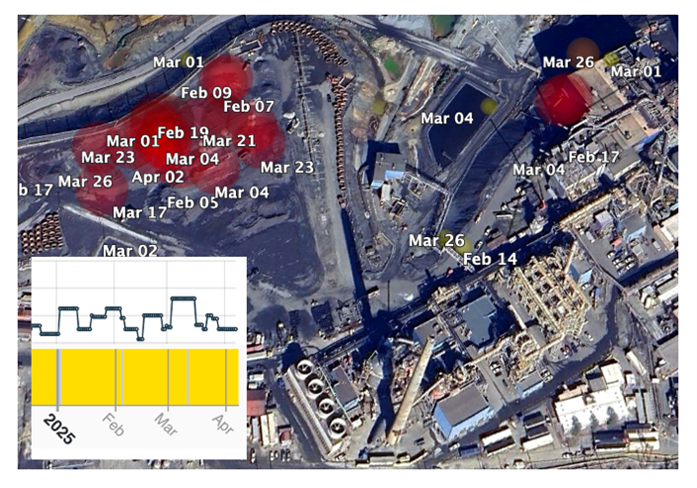

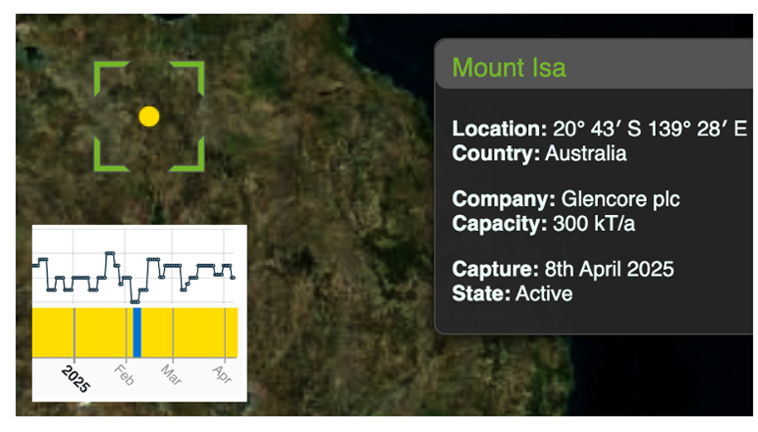

Mount Isa

We had assumed that the closure of the Isabel Leyte smelter would be enough to safeguard the immediate future of smelting at Mt. Isa. Maybe we were wrong as the company has publicly stated that it has asked both the Australian Federal and Queensland governments for assistance, citing subsidies in China and Indonesia. Additionally the eponymous Isasmelt technology that the site uses tends to have a high copper loss to slag

in the initial smelting process that reduces the quantity of free metal, or requires expensive further electric melting and floatation to boost recoveries.

Verdict: Glencore have a history of ‘leaning’ on the Queensland government ahead of the 4-year rebrick of the smelter – next due in 2026 and expected to cost between AU$40 – $60 million. They have previously stated that the smelter – and the Townsville refinery that it supplies anodes to – will not close before 2030. However as we concluded in one of our previous features, ‘the smelters that are most likely to come under pressure are those in locations with high energy costs as well as being remote from regions of strong demand growth and/or access to scrap‘. Mount Isa ticks all of the above boxes.