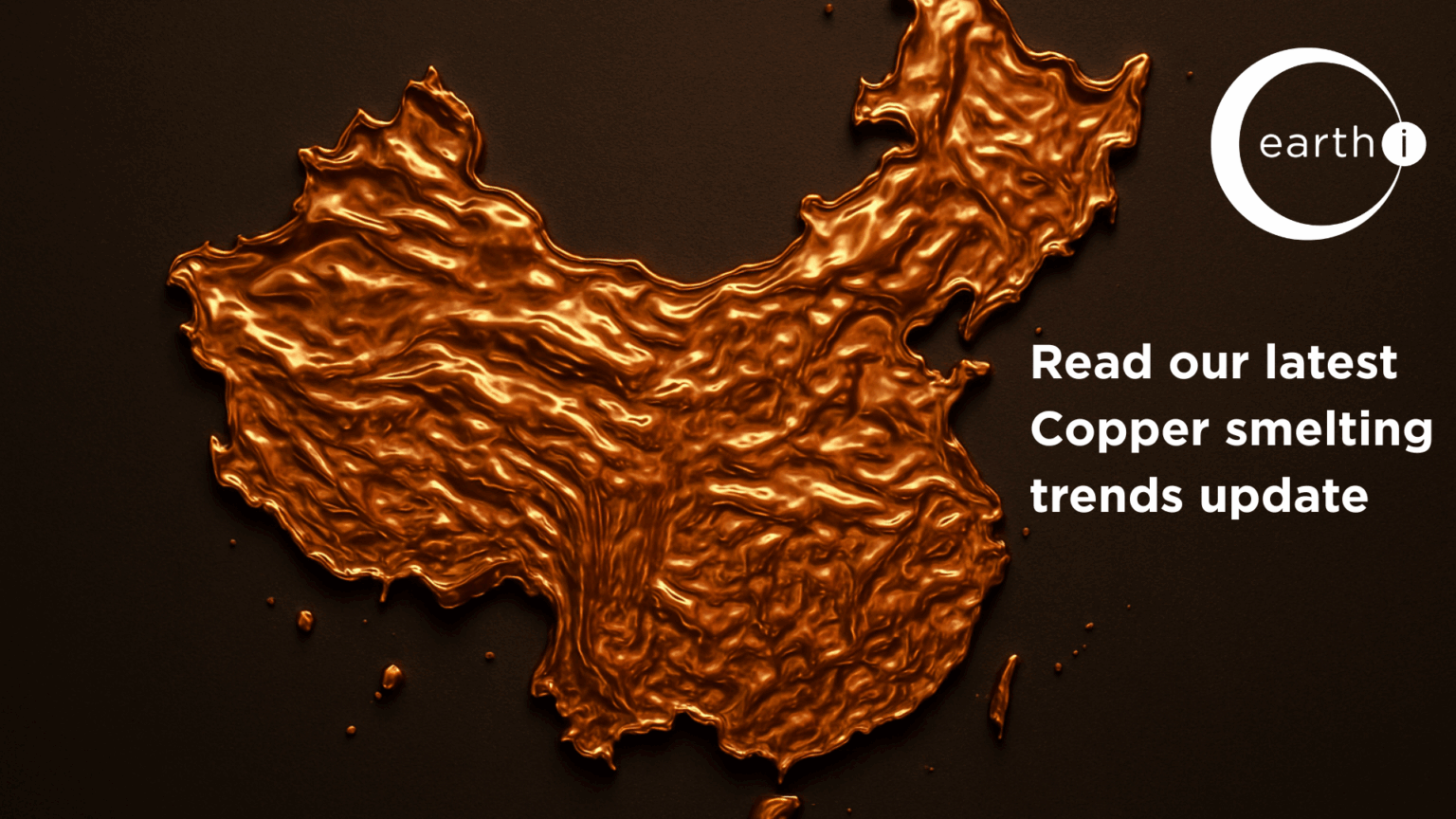

Global smelting activity resumed its decline in June according to data from Earth-i’s SAVANT Global Copper Monitoring Index, falling by 0.9%. Nevertheless, at only 13.9% the global inactivity index remains well below the same period in 2024 (18.6%) indicating that, despite adverse market conditions, competition to secure concentrates remains fierce. This has been further evidenced by the settlement of mid-year terms between Antofagasta and Chinese smelters at a treatment and refining charge (‘TC/RCs’) of zero.

Fig I: Global Inactive Capacity Index, June 2024 – Present, 21 day moving average

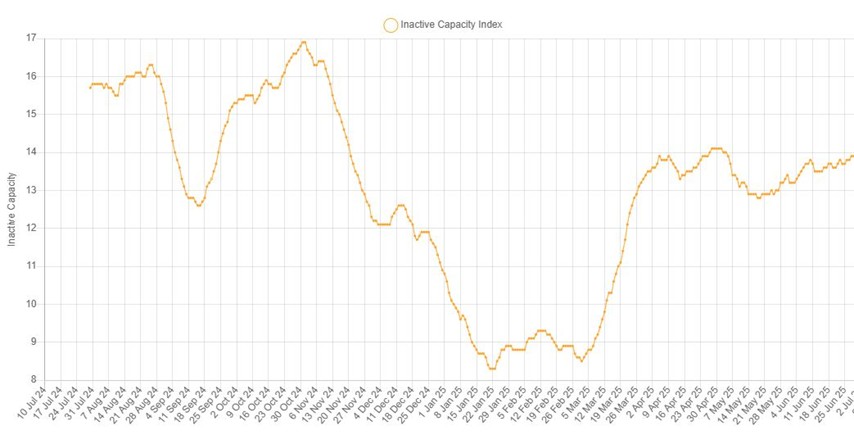

However, there has recently been a notable divergence between China and the Rest of World (RoW), with activity in the former increasing by an average of 0.9% in June as it simultaneously fell by 2.3% in RoW. Indeed, activity has now fallen for five consecutive months in RoW as those operators not shielded from record low TC/RCs by integration with mining assets upstream (‘captive’ smelters), face the prospect of having to reduce capacity utilisation or shutter completely.

Fig II: China and RoW Inactive Capacity Indices, January 2025 – Present, 7 day moving average

Following the closure of Glencore’s 330 kT/a PASAR in March, Sinomine Resource Group’s (Sinomine) 60 kT/a Tsumeb smelter in Windhoek, Namibia is the latest to succumb to market forces. SAVANT monitoring indicates that production at the site in 2025 had already been patchy before Sinomine’s announcement that they were moving the plant to care and maintenance, seeking to reduce costs by 30-40%. Together with ongoing maintenance at FQM’s 300 kT/a Kansanshi smelter, this contributed to an 8.3% increase in regional smelting inactivity in Africa, which at 25.9% is now second only to North America.

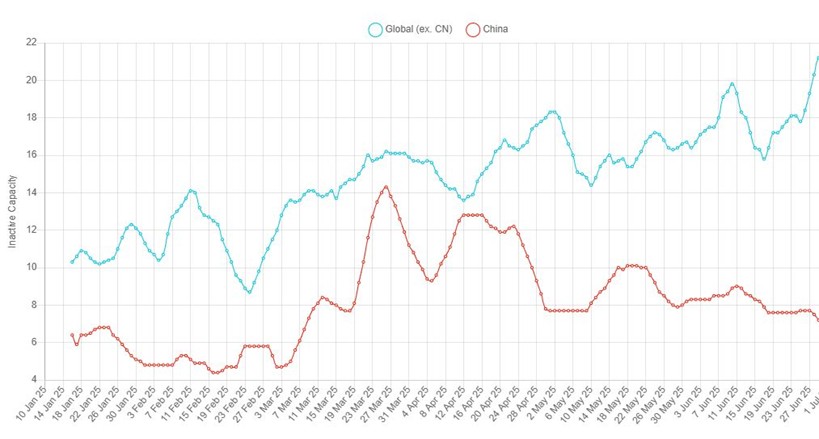

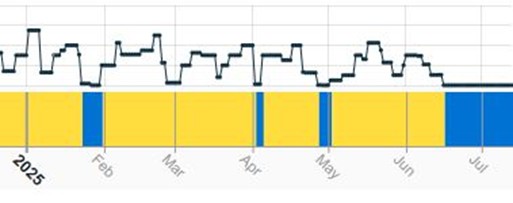

Of the other regions, Europe was the only one to see an increase in activity over the course of the month, rising by 2.9%. Most interestingly, smelting in Asia & Oceania declined by 0.6%, at least in part due to a lack of operating signals at the two Iranian smelters, being National Iranian Copper Industry Company’s (NICICO) 120 kT/a Khatoon Abad and 280 kT/a Sarchesmeh, both in Kerman Province. Inactivity at the latter is particularly notable in light of recent events in the Middle East as we are not aware of any planned maintenance at the facility, which has had a very stable operating history since 2018. No operating signals have been detected from the site since June 16th, three days after the conflict with Isreal began.

Fig III: Sarchesmeh smelter, January 2025 – Present

Yellow = active, blue = inactive, grey = no reading

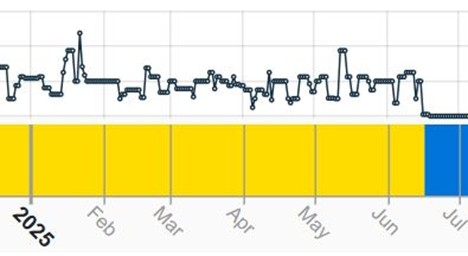

Elsewhere inactivity in North America and South America rose by 4.6% and 5.0% respectively to averages for June of 38.7% and 25.0%. The latter was notable for the chimney collapse at Salvador (sometimes referred to as Potrerillos) that has seen the smelter offline since mid-June, provoking much speculation regarding its long-term viability.

Fig IV: Salvador smelter, January 2025 – Present

Yellow = active, blue = inactive, grey = no reading

* all figures are m/m unless otherwise stated