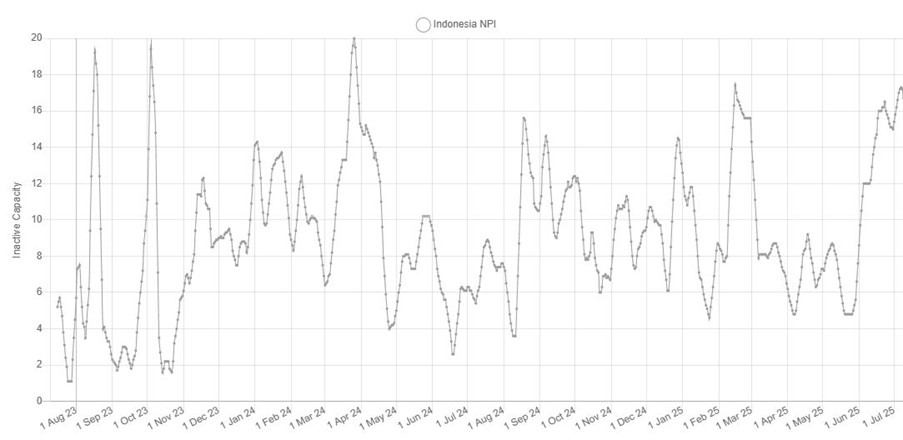

Global nickel smelting activity fell for the first time in four months in June according to data from Earth-i’s SAVANT metals monitoring platform with the global inactive capacity index rising 3.5% to 15.9%. While inactivity climbed across all classes of metal, the most important contributing factor was the increase at NPI operations in Indonesia which jumped by an average of 7.5% month-on-month to 14.4%, the highest level in two years.

Fig I: Indonesia NPI Inactive Capacity Index, June 2023 – Present, 7 day moving average

This is not unexpected following our observation last month that SAVANT monitoring indicated that Tsingshan was likely to have halted operations at its joint venture GCNS and SMI plants in the Morowali Industrial Park. As a result, inactivity at NPI smelters in the SE Asian country now sits 9% above the same period a year ago.

Elsewhere, only in China did smelting activity increase over the month, by 4.8%, so that the country level inactive capacity series fell to 11.6%, second only to Asia & Oceania at 8%. However, the low reading for the latter could be misleading as this region has already seen the closure of significant capacity due to either weak market conditions (KNS’ Koniambo in New Caledonia and BHP’s Kalgoorlie operations in Australia), or war (Solway Investment Group’s Pobuzhskiy in the Ukraine). Most of the remaining plants in this cohort have shown stable operating signals so far in 2025, with the notable exception of Myanmar CNMC’s Taguang Taung smelter in Myanmar, which has been inactive since April 2024, again due to conflict.

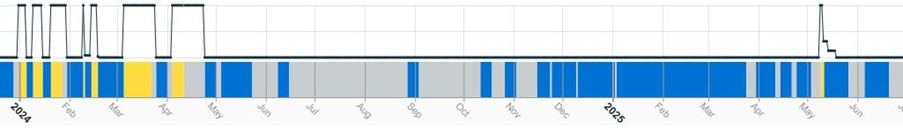

Fig II: Taguang Taung smelter activity, January 2024 – Present

Yellow = active, blue = inactive, grey = no reading

Of the other regions, activity declined in both Africa and the Americas to 26.6% and 45.1% respectively. SAVANT monitoring indicates that a patchy operating performance at Vale’s 27 kT/a Onca Puma ferronickel plant in Brazil was the primary contributor to the 8.3% rise in the regional inactivity series for the former, while a similarly low average utilisation rate at Valterra Platinum’s 16 kT/a Polokwane was mainly responsible for the 20.9% jump in the latter.

Fig III: Onca Puma smelter activity, January 2025 – Present

Yellow = active, blue = inactive, grey = no reading

* all figures are m/m unless otherwise stated