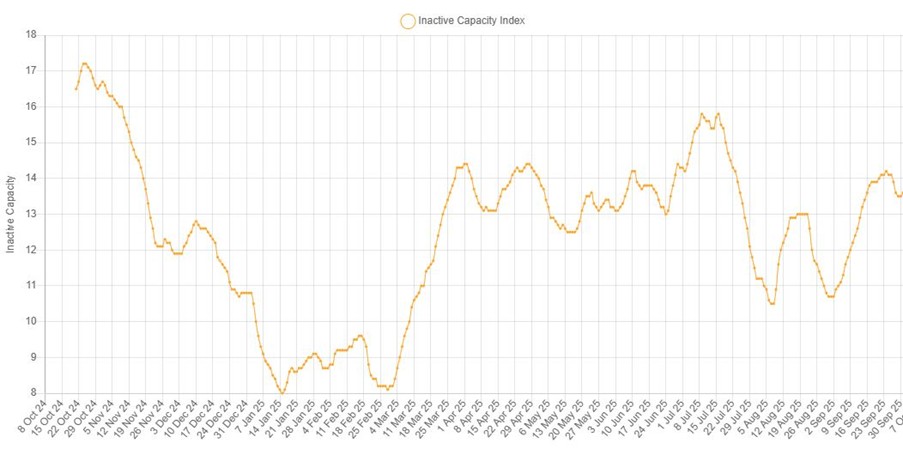

Global smelting activity declined in September according to Earth-i’s SAVANT Global Copper Monitoring Index, with the proportion of global capacity registered as inactive rising by 1.7% to 13.5% over the month. However, the headline figure masks significant differences at a regional level, where divergent trends are acutely evident between China and Rest of World (RoW) smelters.

Fig I: Global Inactive Capacity Series, October 2024 – Present

Despite September usually seeing reduced activity in the lead up to negotiations for next year’s benchmark treatment and refining charges (TC/RCs) between the China Smelter Purchasing Team (CSPT) and the world’s leading miners in LME Week, activity in China rose for the second consecutive month, by 1.2%, so that the country level inactive capacity index now sits at its lowest since February at 6.9%. Given the seasonal nature of the industry, maybe the more pertinent observation is that smelting activity is 3.8% higher in China than the same period a year ago and 2.1% higher than the 3-year average for September from 2022 – 2024. Of course, this was something that we anticipated in our recent blog post Chinese smelters and the annual benchmark: why this time IS different, a hypothesis that has been backed up by news last week that the Australian government has offered Glencore a $600 million lifeline to keep the Mount Isa smelter in Queensland from closing.

In contrast to China, smelting activity in RoW fell by 3.8%, as deduced by a rise in the inactive capacity sub-index from 14.5% to 18.2%, so that activity for this cohort is now 1.5% weaker than a year ago. Indeed, of the five regions that comprise RoW, only in South America did activity increase, although with the continent registering an inactive capacity reading of 31.6%, this nevertheless remains well above the 3-year average for September of 17.9%. The greatest month-on-month change was seen in Africa, where inactivity jumped from 7.9% to 39%. This was the result of downtime at CNMC’s 250 kt/a Chambishi and KCM’s 310 kt/a Nchanga smelters in the Copperbelt. It will be interesting to see how European premia react given the increased importance of imported metal from the Mother Continent in the wake of the diversion of flows from other regions into North American warehouses, taking advantage of the arbitrage between COMEX and LME pricing.

Despite the sharp decrease in activity in Africa, North America is the region with the least active smelters on average after the regional inactive capacity index rose to 42.7%. Meanwhile Asia & Oceania and Europe saw marginal decreases in activity of 0.4% and 0.2% respectively, although both regions are still seeing healthy levels of operation, registering average inactive capacity of less than 10% for the second month running.

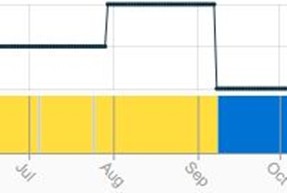

Fig II: Nchanga smelter, July 2025 – Present

Yellow = active, blue = inactive, grey = no reading