Our November copper press release shows that global copper smelting activity fell by a further 0.2% in November according to SAVANT registering the third consecutive monthly decline so that the percentage of world capacity registered as inactive reached 15.3%, the highest reading since October 2024.

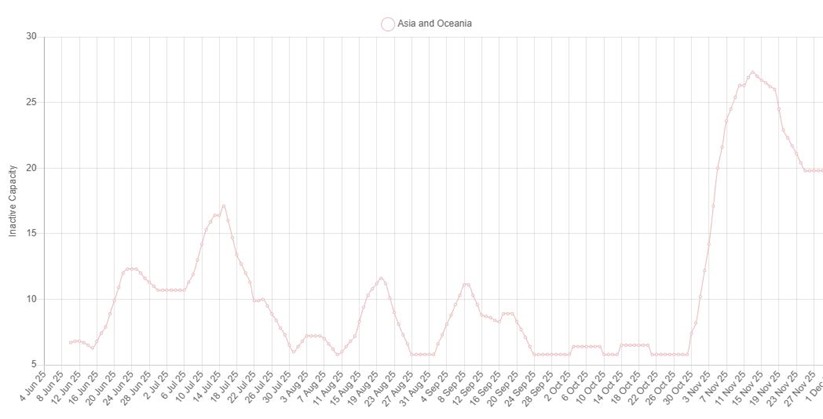

It was a sharp rise in inactivity in the Asia & Oceania region that pulled the global and rest of world indices higher, as the regional inactive capacity series rose from 6.6% to 23%. Previously it was the region with the most active smelters on average, but now sits behind Europe (2.9%), Africa and China (both 10.4%).

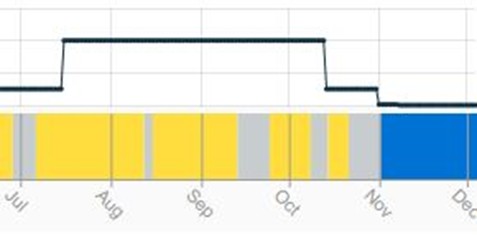

This was in large part due to a lack of operational signals at two of the largest capacity smelters, being Sumitomo Metal Mining’s (SMM) 450 kt/a Toyo in western Japan and BHP’s 250 kt/a Olympic Dam in South Australia. In its fiscal year 2026 statement earlier this year, SMM had flagged a six-week maintenance programme at Toyo commencing in late October. It should be noted that this is part of routine maintenance and unrelated to the parlous state of the smelting industry, where persistently low treatment and refining charges (‘TC/RCs’) are putting many smelters under pressure. Indeed, SMM recently stated that despite prevailing market conditions, ‘the economically best option on the current TC/RC level is to continue operating at full capacity … we do not plan to reduce production volume’.

Fig I: SAVANT inactive capacity series, Asia & Oceania, June 2025 – Present

However, activity in Asia & Oceania can be seen as the exception that proves the rule, as given current copper price dynamics it came as no surprise that smelting activity in all other regions rose. North America recorded the largest gain (of 16.8%) so that the continent’s inactive capacity series now sits at 24.1%, 7% below the same time last year. Meanwhile with activity increasing by 7.4% in Europe (as deduced by a fall in the region’s inactive capacity series of the same magnitude), smelting is now at its highest level this year. In addition, China saw a marked increase in activity, partially reversing October’s rise as the country level inactivity series fell by 3.4% to 10.4%. Indeed, smelting activity in November was 4.9% stronger than the same month last year and 1.7% above the 3-year average.

Fig II: Toyo smelter, July 2025 – Present

Yellow = active, blue = inactive, grey = no reading