Our SAVANT Global Metals Monitoring Index confirmed in January that, with the percentage of global smelting capacity registered as inactive averaging 14.3%, this was the highest reading for January since SAVANT monitoring began nearly a decade ago. Activity fell by 2.5% from December, indicative of the pressure that market forces are exerting on the industry at what is typically the most active period in the calendar. Smelting is markedly weaker than usual, with last month’s inactive capacity reading being the first in 7 years to register double figures for the first month of the year, and 6.8% above the three-year average.

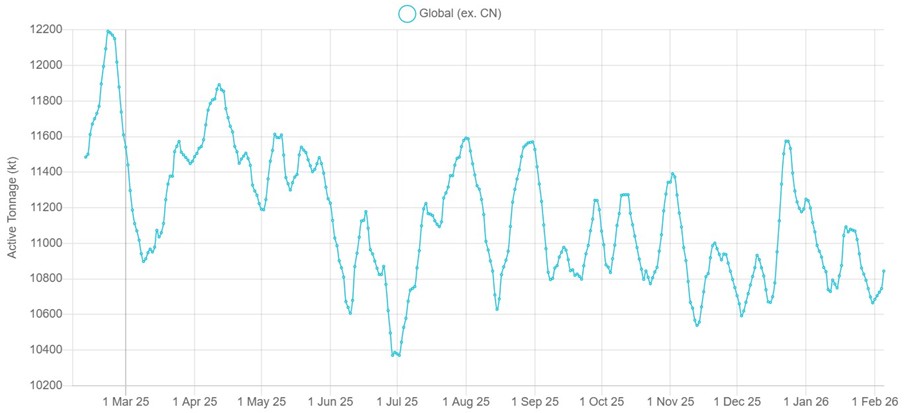

However, at a regional level there is a stark contrast between activity in China, where 45% of capacity monitored by SAVANT is located, and the Rest of World (RoW). With a country level inactive capacity reading of just 7.5% in the former, it is the underperformance of plants in RoW pushing the global index higher, with active tonnage over 1.2 Mt lower than the same time a year ago.

Fig I: SAVANT Active Tonnage, RoW, March 2025 – Present

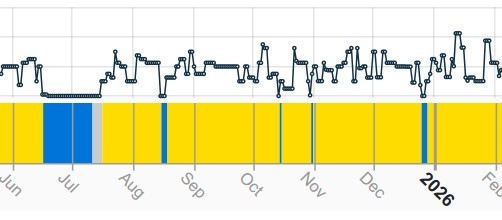

Asia & Oceania is the region responsible for over 850 kt of this change, a result of the closure of the Isabel Leyte (PASAR) plant in the Philippines, as well as the temporary shuttering of the Gresik and Manyar smelters in Indonesia following the catastrophic mud rush incident at the associated Grasberg mine in September. It should be noted that SAVANT monitoring has not detected any interruptions to smelting in Iran over the last month, with both Sarchesmeh and Khatoon Abad showing strong operating profiles. South America and Europe are the other regions that have seen a significant decline in active tonnage of more than 100 kt, in the former mainly due to the closure of Salvador (Potrerillos) in Chile following a chimney collapse in June 2025.

In light of the above it was therefore somewhat ironic that Asia & Oceania was the only region to record a month-on-month increase in smelting activity, of 4.7%. Activity showed the greatest relative fall in Africa where the continent’s inactive capacity series rose by 12.9% to 28.4%. The irony was again apparent as January witnessed the first operating signals from the new 500 kt/a Kamoa-Kakula smelter in the DRC, which while in ramp up currently sits outside the index but when included will bolster active tonnage across the Mother Continent to around 1.45 Mt.

Fig II: Sarchesmeh smelter, July 2025 – Present

Yellow = active, blue = inactive, grey = no reading