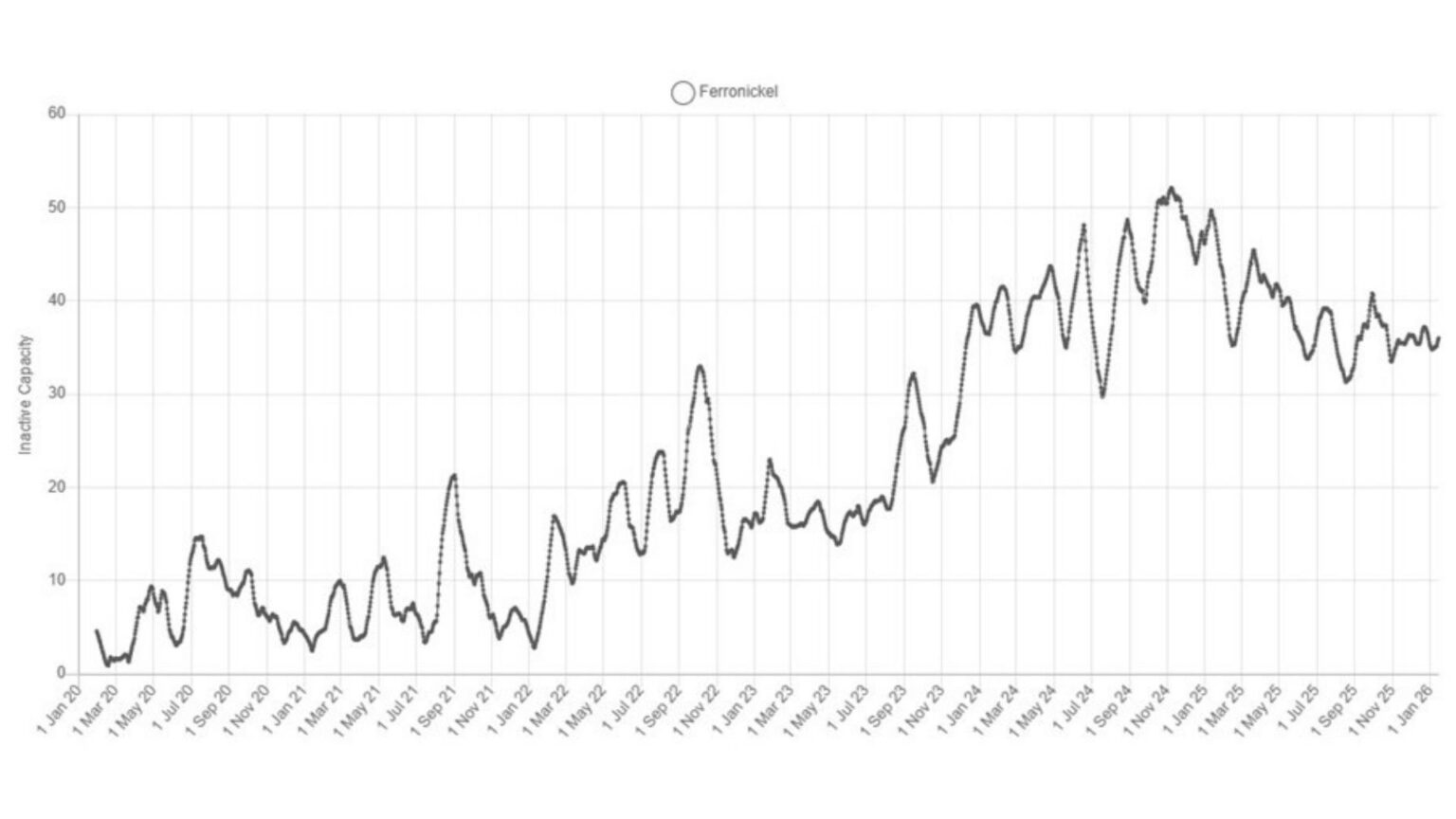

Across the many and varied base metals operations that SAVANT has been monitoring for almost a decade, maybe the most unloved cohort has been the nineteen (remaining) sites that make up the global ferronickel industry. While a couple have had the misfortune to be located in war zones – being Pobuzhskiy in Ukraine and Tagaung Taung in Myanmar – the malaise that saw collective inactive capacity rise consistently between 2020 – 2024 was primarily in response to a lack of competitiveness by comparison to burgeoning nickel pig iron (NPI) capacity. However, since reaching a nadir in November 2024 at over 50%, smelting has increased steadily so that now ‘only’ around a third of capacity in the index is offline. So, what has prompted this reversal in trend?

Chart 1: SAVANT Ferronickel Inactivity Capacity Index, 30 day moving average, 2020 – 2025

Firstly, there has certainly been pull from the demand side and stainless steel in particular, the traditional home for the majority of ferronickel output. As the World Stainless Steel Association (previously the International Stainless Steel Forum) note, global melt of stainless grew by over 7% in 2024 to almost 63 million tonnes. In addition, the percentage of this quantity that is nickel-containing – commonly referred to as the ‘austenitic grades’ of 200 and 300 series steels that typically have loadings of between 1-3% and 8-9% nickel respectively – has held firm at around 80%. SMM has opined that in 2026 it expects the share of nickel demand from stainless, as opposed to other applications such as batteries or electro-plating, will rise to 69% of total consumption of nickel, further cementing its pre-eminent position before increasing to 72% by the end of the decade.

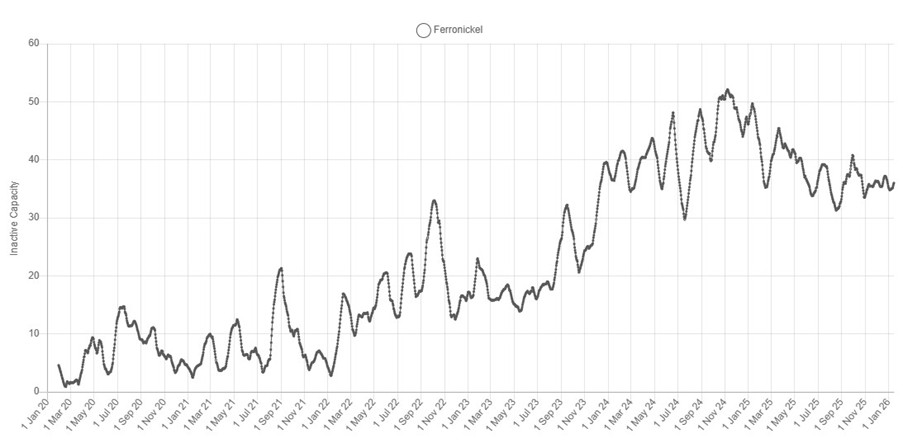

So where are the operations that have been quick to capitalize on the opportunity afforded by the health of the stainless steel sector? The improvement in global ferronickel smelting activity has certainly not been driven by a recovery in Europe (sic. yet?), where high electricity prices have rendered the plants at Larymna in Greece, NewCo Ferronikeli in Kosovo and Euronickel Industries Kavadarci in North Macedonia uneconomic. At the same time the war in Ukraine has meant that SAVANT has not detected any operating signals at Pobuzhskiy since October 2022. Only the multi-metal smelter at Treibach-Althofen in Austria has contributed to regional ferronickel production in the last few years, but with a capacity of only 2kt/a, its contribution to the global ferronickel index is small.

Chart 2: SAVANT monitored nickel production, Southern and Eastern Europe, 14th January 2026

Yellow = active, blue = inactive, grey = no reading

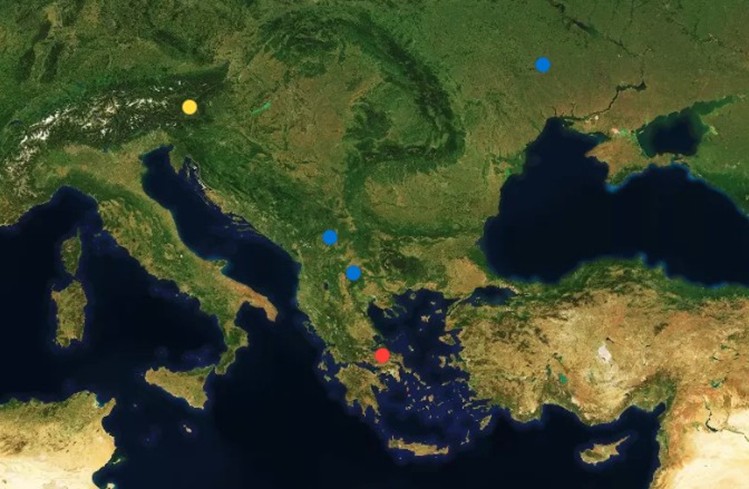

With the construction of the 36 kt/a Barro Alto and 27 kt/a Onca Puma smelters in Brazil at the beginning of the last decade, South America emerged as an important source of class II metal, even allowing for the demise of the Loma de Niquel facility following its forced take over by the Venezuelan government in 2012. Both operations had issues in commissioning due to their rectangular furnace designs that required rebuilds and it is no coincidence that a six month period of inactivity in late 2024 / early 2025 at Onca Puma coincides with the peak in the global inactive capacity series. Nonetheless, as SAVANT monitoring in Chart 3 shows, since then the smelter’s operating profile has been fairly consistent. Another plant that had a better year in 2025 was New Caledonia’s Doniambo. Located in the French territory’s capital city, Noumea, it was severely impacted by civil unrest that broke out in May 2024. And while the expectation is that 2025 output will still be well below nameplate capacity of 56 kt/a, the floating power plant that has replaced the now-closed thermal station onsite appears to have added some stability to operations, even if this is an expensive source of crucial electricity.

Chart 3: Onca Puma, 2023 – Present

Yellow = active, blue = inactive, grey = unknown

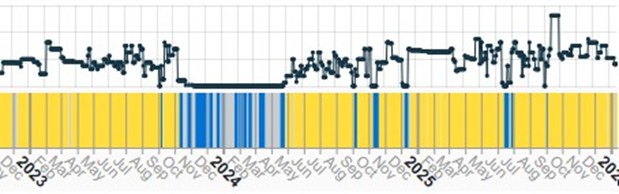

As such it might be argued that the recent improvement in ferronickel industry dynamics is coincidental – a function of a confluence in specific factors at disparate sites. However this is to overlook recent developments in price that could be the catalyst for a brighter future for the industry. Since almost setting 4-year lows in the middle of December at around $14,250 /t, nickel prices have soared, nearly reaching $19,000 /t earlier this month as part of a broader move higher across the base metals complex, as well as continued speculation regarding the extent of cuts to 2026 nickel mining quotas by Indonesia’s Ministry of Energy and Mineral Resources (ESDM). Could it be just another coincidence that concurrently we have seen the first operating signals in nearly 3 years from Solway’s Fenix smelter in Guatemala?

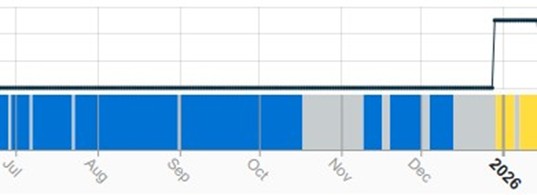

Chart 4: Fenix, July 2025 – Present

Yellow = active, blue = inactive, grey = unknown

In addition, the relocation of stainless capacity to Indonesia may (sic. perversely?) offer further opportunities for ferronickel players. While many of these mills have been established to take nickel units from integrated NPI plants, if ESDM cut back mining quotas they may need ‘top-up’ quantities of ferronickel to supplement local NPI output. And as scrap ratios are much lower than in traditional centers (the INSG does not give a figure for Indonesia but estimates China at just 20% compared to Europe and Japan at 70 – 75%), the requirement could be acute. Additionally, the introduction of the Carbon Border Adjustment Mechanism (CBAM) in Europe will heavily penalise imports of stainless steel made using the carbon-intensive embedded emissions of coal-powered NPI.

As they say, everyone loves a good comeback story and 2026 might just be the year for ferronickel’s revival.