In our latest press release, we explore how global smelting activity increased for the second month in a row according to our SAVANT Global Copper Monitoring Index which showed that 11.8% of global capacity was inactive, a 1.8% fall from July. Indeed, smelting activity was almost universally strong month-on-month, with the only region to record a decline being South America.

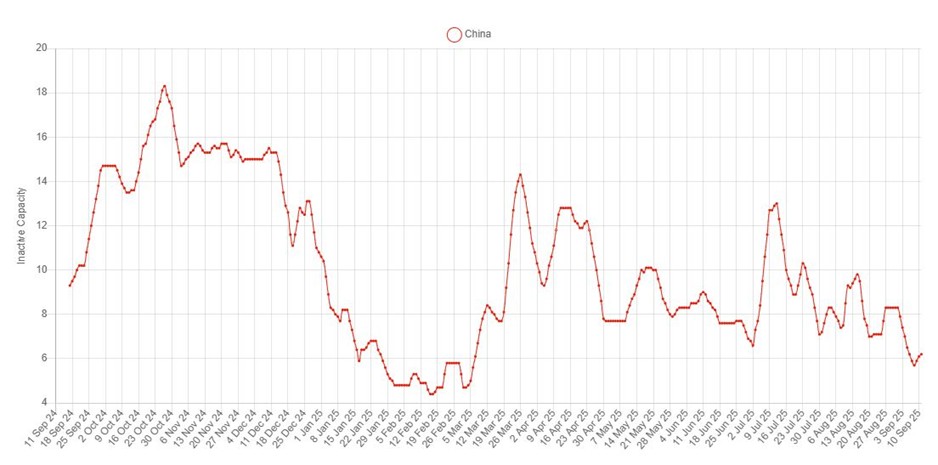

As we anticipated in our recent blog post Chinese smelters and the annual benchmark: why this time IS different, smelting activity in China rose by 1.6% (as deduced by a fall in the country level inactive capacity index of the same quantum) and now stands 4.6% stronger than the same time a year ago. With local smelter groups reporting decade-high profits for the first half of 2025, despite record low treatment and refining charges (‘TC/RCs’), maintenance shutdowns and outages were limited in August with only Jinchuan’s eponymous 300 kt/a Gansu, CNMC’s 55 kt/a Fubang and Dongying’s 400 kt/a Shandong Fangyuan plants showing periods of more than 5 days where they were offline.

Fig I: China Inactive Capacity Series, September 2024 – Present

Simultaneously activity in other regions also increased with the RoW inactive capacity index falling by 2% to 14.5%. In similar fashion to China, smelting activity is also stronger year-on-year, by 2.5%. Europe continues to be the region with the most active smelters on average, where the inactive capacity series fell for the third consecutive month, by 4.4% to 6.5%. Africa also joined Europe and Asia & Oceania (7.6%) in registering inactive capacity for the month at less than 10%, recording an 11.6% fall to 7.9%, the lowest reading for the Mother Continent since January 2022. However, it seems likely that this could be short-lived as the first half of September has seen CNMC’s 250 kt/a Chambishi and KCM’s 310 kt/a Nchanga plants register periods of inactivity.

Meanwhile the Americas continue to register the lowest levels of smelting activity across the globe, with South America leapfrogging North America to become the region with the highest level of inactive capacity at 40.2%. This is in part due to the extended shutdown of Codelco’s Salvador (also known as Potrerillos) 200 kt/a smelter following a chimney collapse in June, joined by the Chilean state-owned miner’s 400 kt/a El Teniente facility following a fatal accident in late July that led to the temporary shutdown of operations at the integrated site.

Fig II: Chambishi smelter, January 2025 – Present

Fig III: El Teniente smelter, January 2025 – Present

Yellow = active, blue = inactive, grey = no reading