Earth-i’s latest monthly analysis of the global copper market shows that smelting activity increased in July as an average of 13.6% of global capacity was inactive, a fall of 0.4% from the prior month.

In a reversal of the recent trend, it was strength in smelting activity in the Rest of World (RoW), which rose for the first time since January, that helped offset a weaker reading in China, where activity fell by 1.9%. Nevertheless with inactivity for the month averaging only 9.8%, operators in the world’s second largest economy continue to defy punitive treatment and refining charges (‘TC/RCs’) compared to their counterparts in RoW, where inactivity still registered 16.4% over the month.

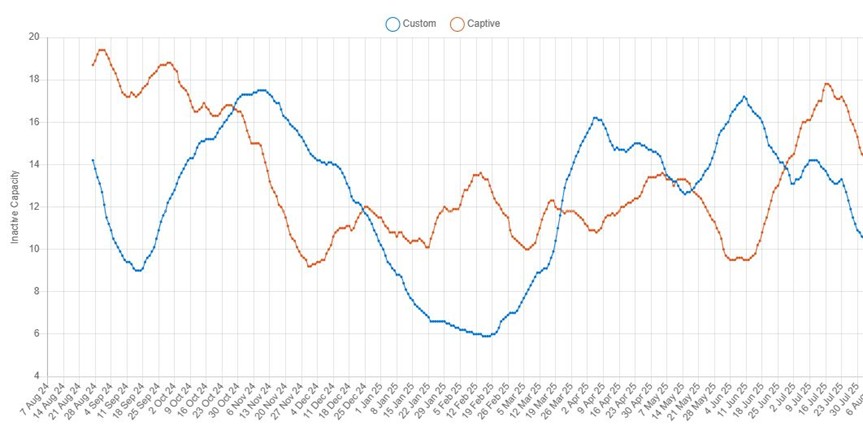

It was also interesting to note the different behaviours between ‘custom’ smelters, those that do not get their concentrate feed from integrated mines upstream, and ‘captive’ smelters which do. Activity at the former increased by 2.3% while the cohort of the latter showed a decrease of 2%, in part due to downtime at Zijin Mining’s 150 kT/a Qiqihar in Heilongjiang (see Fig II). With an inactive capacity reading of 12.2% compared to 15.4% for captive plants, custom smelters were therefore more active as a group for the first time since February.

Fig I: Custom and Captive smelters’ Inactive Capacity Index, August 2024 – Present, 21 day moving average

We believe there are two main reasons for this. Firstly, captive smelters are more likely to be located in traditional mining jurisdictions, where employees take extended breaks for summer holidays. As such operators will plan for maintenance periods to coincide with reduced workforce availability. Added to this is the tendency for custom smelters to increase production now before reducing activity in September – October to coincide with negotiations for next year’s benchmark TC/RCs, commonly known as ‘mating season’ in the industry, where it is in their interests to present the appearance of a ‘loose’ market and the appearance of sufficient concentrate availability.

At a regional level, Europe saw the biggest increase in activity, with the continent’s inactive capacity series falling by 8.6% to 10.9% in large part due to the return of Aurubis’ 360 kT/a Pirdop plant in Bulgaria following a $137 million overhaul (see Fig III). Together with Asia & Oceania’s inactive capacity series rising by 2.3% to 11.2%, Europe is now the most active region after China, while despite an improvement of 7.1%, North America remains that with the highest level of inactivity at an average of 31.6%. Meanwhile Africa also saw a fall in inactivity of 6.3% to 19.6% with FQM’s 300 kT/a Kansanshi coming back online (see Fig IV), while South America was the most stable of the regions, recording a 0.4% increase in inactivity to 25.4%.

Finally, last month we noted what appeared to be interruptions at the smelters owned by National Iranian Copper Industry Company’s (NICICO), being 120 kT/a Khatoon Abad and 280 kT/a Sarchesmeh. Both have now been showing consistent operating signals since at least the middle of July, with the profile at Sarchesmeh especially indicative of a standard 4-5 week major maintenance period.

Fig II: Qiqihar smelter, January 2025 – Present

Fig III: Pirdop smelter, January 2025 – Present

Yellow = active, blue = inactive, grey = no reading

Fig IV: Kansanshi smelter, January 2025 – Present

Yellow = active, blue = inactive, grey = no reading

See more about Earth-i’s SAVANT Global Copper Monitoring Index.