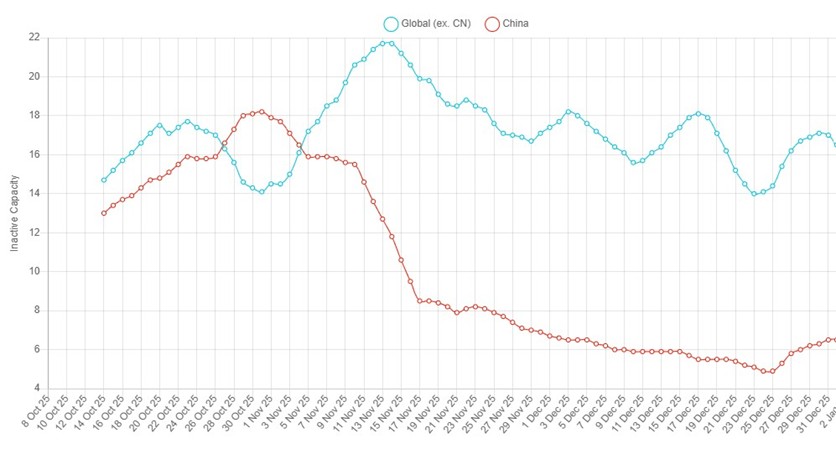

In our January 2026 press release, we are able to confirm that global smelting activity rose for the first time in four months according to our SAVANT Global Copper Monitoring Index, with the percentage of world capacity registered as inactive falling by a hefty 3.4% to 11.8%, the largest single-month decline since December 2023.

While smelting activity increased in RoW by 2.5%, it was the 4.6% rise in China that was most responsible for the change in the global index. At only 5.8%, the country-level inactive capacity series is now 7.3% below the same time a year ago and 5.5% below the three-year average.

This speaks to the yin and yang currently at play in the copper midstream. On the one hand, disruptions to mine supply are limiting the availability of concentrate feed to smelters, forcing ever more punitive treatment and refining charges (‘TC/RCs’) on them, thereby encouraging operators to take an increasing proportion of scrap into their furnaces. Simultaneously, this tightness in raw material markets, as well as the pull from the US of higher prices on COMEX, is driving copper to record highs and incentivising smelters, regardless of jurisdiction, to maximise production. As such of the 49 smelters that collectively make up the SAVANT China index monitoring failed to detect activity signals lasting more than five days at only two sites, being Tongling’s 400 kt/a smelter in Anhui province and Huludao’s similarly eponymous 100 kt/a plant in Liaoning.

Fig I: SAVANT inactive capacity series, China and RoW, October 2025 – Present

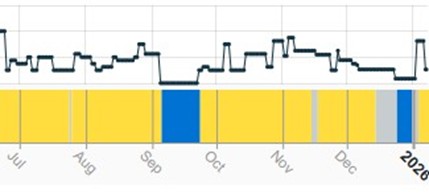

Of the other regions, only Africa and Europe saw inactivity rise, by 4.8% and 2.4% respectively, although these still rank as the top two regions for smelting activity on average, with their inactivity readings of 15.2% and 5.3% both lower than the same period a year ago. These slight falls in activity were primarily the result of downtime observed at CNMC’s Chambishi 250 kt/a smelter in Zambia and Aurubis’ 180 kt/a multi-metal recycling plant at Huettenwerke Kayser (Lunen) over the Christmas period.

Elsewhere, smelting activity increased in North and South America by 4.3% and 4.0%, as well as in Asia & Oceania by 5.5% as Sumitomo’s Toyo smelter came back online in the middle of the month following a 6-week shutdown for planned maintenance.

Fig II: Chambishi smelter, July 2025 – Present

Yellow = active, blue = inactive, grey = no reading