Nickel smelting activity fell in November as both ferronickel and nickel pig iron (NPI) sub-indices declined, more than offsetting continuing strength in Class 1 production. Earth-i’s SAVANT metals monitoring index rose by 0.4% to 18%, indicating that on average almost a fifth of total smelting capacity was inactive over the month.

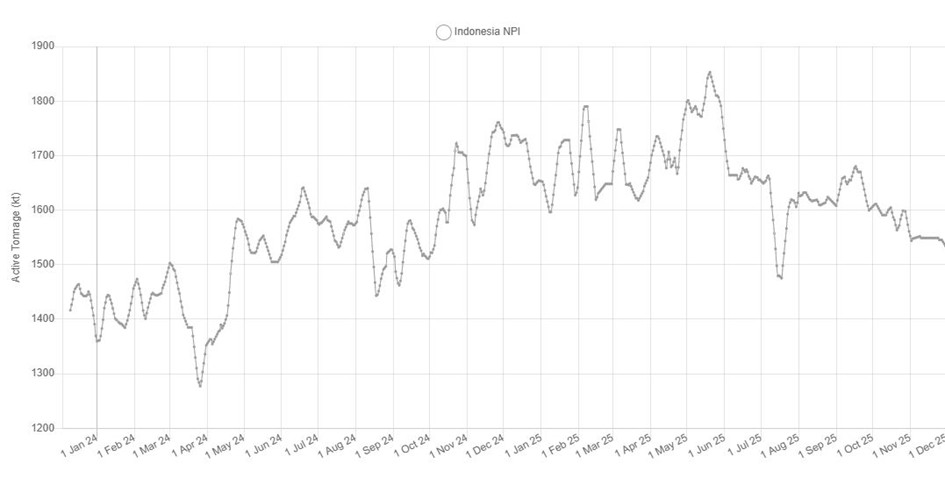

This was in large part due to a decline of 2.4% in Indonesia, the world’s leading producer of nickel and home to more than half of total operating capacity monitored by SAVANT. At 16.1%, inactivity is at its highest since March 2024. It should however be noted that due to the increase in installed capacity over the last 18 months, active tonnage is now 29% higher than it was back then at over 2 million tonnes.

Fig I: SAVANT Indonesia NPI Active Tonnage Index, Jan 2024 – Present

Looking at the NPI segment, which accounts for 50% and 80% of all operating capacity in China and Indonesia respectively, an increase in activity of 4.3% in the former (as deduced by a fall of the same magnitude in the country level NPI sub-index to 25.1%), was not enough to offset a 2.1% decline in the later. This is because NPI active tonnage in China is now less than a third of that in the Southeast Asian archipelago. Consequently, the NPI inactive capacity sub-index rose by 0.5% to 19.7%, 8.8% above the same time last year and 6.6% above the 3-year average.

Activity in higher quality Class II ferronickel, which has been usurped in many supply chains over the last 20 years by lower cost NPI, fell by 2.5% so that the metal grade inactive capacity sub-index rose to 36.3%. Meanwhile, as we noted in our latest feature report ‘How green premiums could return hegemony to the LME’, signals from operations producing Class 1 nickel continue to strengthen, with the inactive capacity sub-index for metal that can be delivered to the LME falling by 0.8% to just 4.7%. As such we would expect stocks on the Exchange, which are already above 255,000 t, to keep rising in the short term.

At a regional level, Africa and Asia & Oceania gave the strongest monthly performances with both regions registering inactive capacity of less than 10%, in stark contrast to Europe and the Americas, which showed inactive capacity readings of 53.6% and 31.4% respectively.