Our February Nickel update confirmed that global smelting activity fell in January according to our SAVANT metals monitoring index, as the percentage of the world’s smelting capacity registered inactive increased by 0.2% to 16.7%.

Last month also saw the fourth consecutive monthly fall in activity in the world’s largest producer, Indonesia, where the country level inactive capacity series rose by 2% to 18.8%, the highest reading since November 2018. As we highlighted last month, operators appear to be acting with an abundance of caution as they wait for the finalisation of Ministry of Energy and Mineral Resources (ESDM) quota allocations for 2026.

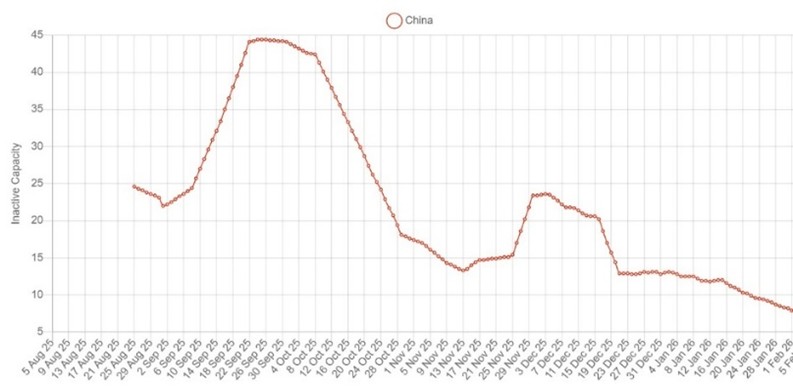

The decrease in global smelting would have been greater but for a strong performance in China, where smelting activity increased by 4.1%, as deduced by a fall in the inactive capacity series from 12.9% to 8.8%. However, with China now home to only 729 kt of active tonnage due to the relocation of much of the nickel pig iron (NPI) industry to Indonesia, which boasts almost 1.95 Mt of active capacity, this was not enough to prevent a fall in the global series. Indeed, although Indonesia currently has a high percentage of capacity that would seem not to be operating, due to the ongoing build out of the industry, active tonnage is nonetheless 272 kt above the three-year average.

Fig I: SAVANT China Inactive Capacity Index, 21-day moving average, August 2025 – Present

Of other regions, the Americas were notable for recording an active capacity reading of 268 kt, the highest figure in almost three years, with the region seeing a fall of 3% in its inactive capacity series to 15%. Asia & Oceania remains the region with the lowest average inactive capacity at 6.1%, down from 8% in December.

Meanwhile smelting activity for all grades fell in January, with Class I nickel registering the largest decline of 0.6%, although with inactive capacity averaging just 2.4% it remains the strongest of the three grades. Ferronickel is still the weakest with 36.1% of total capacity registered as inactive (for a full analysis of the segment please see our recent thought piece ‘Could ferronickel be making a comeback?’), while NPI sits midway between the two at 18.5%.