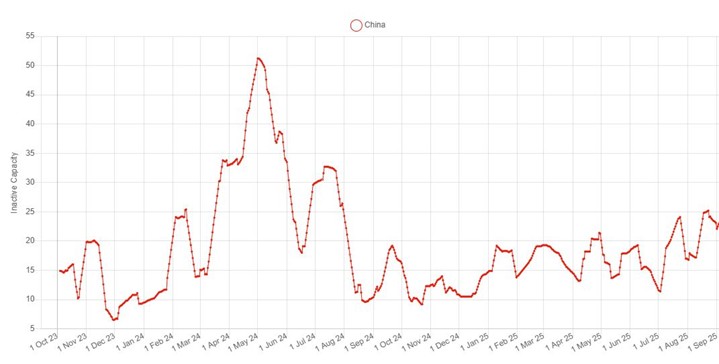

In our latest press release, we highlight how global nickel smelting activity rose for the first time in three months according to data from Earth-i’s SAVANT platform with all regions except Europe seeing gains. The fall in the Global Inactive Capacity Index of 2.2% to 16.4% was underpinned by improved activity in both Indonesia and China, where the country level inactive capacity series shed 1.9% and 1.2% respectively on average in August.

Nonetheless inactivity in China remains high at 20.8%, indicative of an industry that is likely experiencing rationalisation as part of the ‘anti-involution’ campaign. The buzz word refers to the build out of excess capacity which subsequently leads to price wars and structurally low profitability, something that the nickel industry in China has been struggling with for many years. And while many operations have already been shuttered, there are still signs that further cuts are taking place. For example, SAVANT monitoring indicates that Tangshan Kaiyuan Industrial Company’s eponymous 27 kt/a NPI plant in Hebei has been mostly inactive for other three months now.

Fig I: China Inactive Capacity Index, October 2023 – Present, 21 day moving average

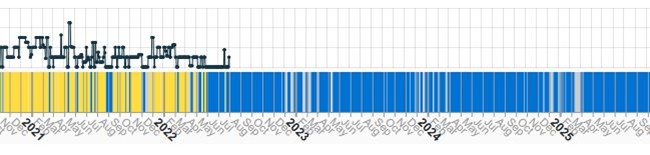

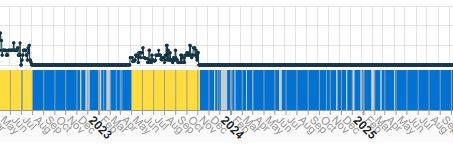

Similarly, while activity at ferronickel operations globally improved by 2.3%, this comes from a high starting point so that inactivity for the cohort remains elevated at 30.9%. It also masks considerable differences at a regional level. In Europe, NewCo Ferronikeli and Euronickel Industries’ plants in Kosovo and North Macedonia have been inactive since at least the start of 2024, while LARCO’s plant in Greece closed in mid-2022. As a result the regional inactive capacity series has been above 50% since October 2023, remaining stable in August at 55.2%.

Conversely, a falling regional inactive capacity series for the Americas, which shed 7.7% to 38.4%, was in large part due to the continuing resilience of South America’s ferronickel facilities. Indeed, all four ferronickel smelters in Brazil showed uninterrupted operating profiles for the second consecutive month.

Of the other regions Africa continues to be the region with the most active smelting capacity as the region recording a perfect operating record for the month with no inactivity, while in Asia & Oceania the regional inactive capacity index fell by 0.4% to 6.1%.

Fig II: LARCO (Larymna) smelter activity, November 2020 – Present

Yellow = active, blue = inactive, grey = no reading

Fig III: Euronickel Industries (Kavadarci) smelter activity, May 2022 – Present

Yellow = active, blue = inactive, grey = no reading