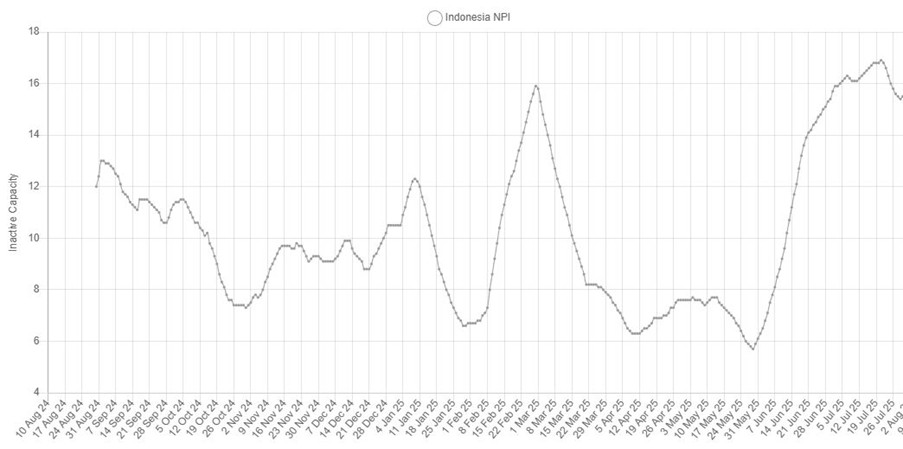

Global nickel smelting activity fell for the second consecutive month in July according to data from Earth-i’s SAVANT Global Smelting Monitoring Index, driven by continuing weakness in Indonesia and further corroborating the tough market conditions faced by operators. Indeed, nickel pig iron (NPI) operations in the SE Asian archipelago recorded their highest level of inactivity since November 2022, at 15.9%. Simultaneously, smelting activity in China fell by 10.5%, contributing to the Global Inactive Capacity Index rising by 2.6% to 18.6%, its highest reading in over a year.

Fig I: Indonesia NPI Inactive Capacity Index, August 2024 – Present, 21 day moving average

While we previously commented on the decision by Tsingshan to halt operations at its joint venture GCNS and SMI plants, a response to an oversupplied market and depressed nickel prices, in July we also observed periods of inactivity at two of the company’s other large JV sites in the Morowali Industrial Park, namely the 60 kT/a ITSS and 36 kT/a IRNC smelters. In addition, PT Kalimantan Ferro Industry’s 18 kT/a plant KFI in East Kalimantan also contributed to the 1.5% weaker month-on-month performance.

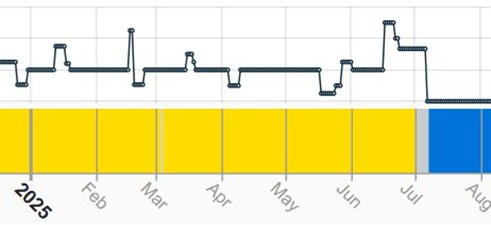

Meanwhile the jump in the country level inactivity series for China from 11.6% to 22.1% was difficult to isolate to specific plants given the increasingly fragmented nature of the domestic industry, save for Tangshan Kaiyuan Industrial Company’s eponymous 27 kT/a NPI plant in Hebei, which we have observed as inactive since July 7th (see Fig II). This marks the longest period of inactivity at the site since 2018.

Fig II: Kaiyuan NPI smelter activity, January 2025 – Present

Yellow = active, blue = inactive, grey = no reading

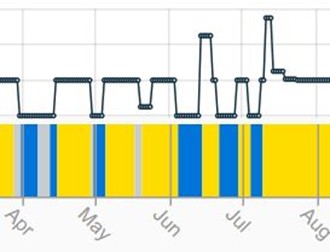

Of the other regions Africa saw the greatest month-on-month change in activity, with the Mother Continent’s inactivity capacity series falling by 19.5% to 7.2%, in large part due to a more consistent operating performance in July at Valterra Platinum’s 16 kT/a Polokwane smelter in South Africa’s Limpopo province (see Fig III), in combination with continued strength at Implats’ 18 kT/a Impala at Rustenburg in the North West province.

Fig III: Polokwane smelter activity, April 2025 – Present

Yellow = active, blue = inactive, grey = no reading

Activity also increased in Europe by 6% m/m, although with an inactivity reading of 55.2% the region remains the weakest performer globally. At the other end of the spectrum, activity in Asia & Oceania also increased, by 1.5%, so that the latter remains the most active region for nickel smelting relative to capacity.

Lastly, although the regional incapacity index for the Americas rose by 1% to 45.1%, this masks a solid performance in South America, with all four of the continent’s ferronickel smelters displaying good operating profiles. This comes on the back of news early in July that South32 has entered a binding agreement with CoreX Holding to sell its 55 kT/a Cerro Matoso ferronickel smelter in Columbia for up to US$100 million.