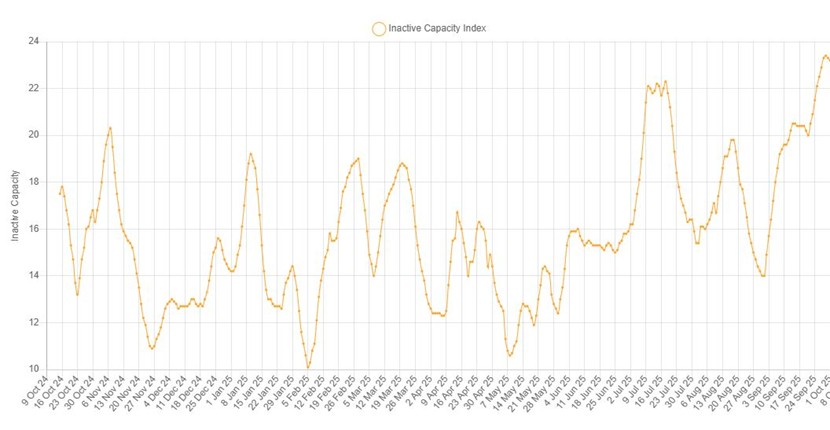

In this month’s press release covering the global nickel market, we report on how smelting inactivity has risen to a 17-month high.

World nickel smelting activity fell by 4.4% over September according to data from Earth-i’s SAVANT inactive capacity index. At a reading of 20.8%, the global inactive capacity series is now at its highest since April 2024. Similar then, the move higher was in large part due to a fall in activity in China, where the country level inactive capacity index rose for the third consecutive month, accelerating in September by 22.1% to 42.9%.

Fig I: Global Nickel Inactive Capacity Index, October 2024 – Present

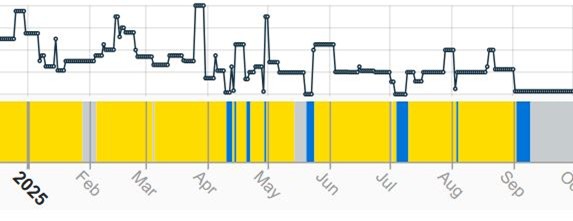

As we highlighted in our recent feature article China’s anti-involution campaign – back to the future, active tonnage in the country has been falling since the middle of the year. Additionally, last month saw the country’s two largest nickel pig iron (NPI) plants, being Shandong Xinhai’s 190 kt/a plant at Linyi and Jiangsu Delong’s 100 kt/a smelter at its Yancheng Xiangshui steelworks, register periods where SAVANT monitoring could not detect any active operational signatures.

As a result the inactive capacity sub-index for NPI operations globally also rose, by 7.5% to 23%, despite an increase in smelting activity in Indonesia. In the world’s largest producer of nickel, smelting activity rose by 0.5%, so that at 11.5% the country level inactive capacity index now stands at its strongest since May for the SE Asian archipelago.

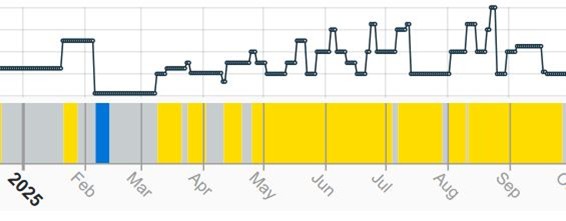

Meanwhile in other regions activity is remarkably similar to this time a year ago. In Europe and Africa, the inactive capacity series were exactly the same as September 2024 at 53.5% and 11.8%, while in Asia & Oceania and the Americas activity is marginally stronger, showing inactivity readings of 9.3% and 38.8% respectively. Consistent operating profiles at both Implats’ 18kt/a Impala Mineral Processing Plant and Northam Platinum’s smaller 2 kt/a Zonderinde smelter in South Africa’s Bushveld Complex contributed to strength in the Class 1 nickel, so that with an inactive capacity reading of 5.3%, this is now the most robust of all of metal type/regional sub-indices.

Fig II: Shandong Xinhai smelter activity, Jan 2025 – Present

Yellow = active, blue = inactive, grey = no reading

Fig III: Impala Mineral Processing Plant activity, Jan 2025 – Present

Yellow = active, blue = inactive, grey = no reading