With the end of what has been another tumultuous year for the copper smelting industry fast approaching, it’s time for our bumper edition, Christmas Special! So, kick back and relax as the kids enjoy their comic annuals (are they Beano or Dandy readers?), put a log on the fire, get yourself a mug of something warm and let us recap the 2025 smelting year for you.

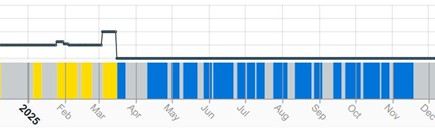

We opened 2025 with the hypothesis that Chinese smelters would take their lead from the pragmatic economic philosophy of Chairman Deng and look to force weaker players out of the market, even if this might cause them some short-term pain. In our article ‘Cat Theory and The Great Copper Conspiracy’ we highlighted the smelter at Isabel Leyte in the Philippines as being particularly at risk. Sadly, for the c.1,000 employees we were correct, with owner’s Glencore announcing the shutdown of the plant such that SAVANT monitoring of the site shows that there has been no activity since March 15th. The sale of the asset to the Philippines’ Villar family, which completed in September, may offer hope for a happier New Year.

Chart 1: SAVANT inactivity observations, Isabel Leyte smelter, 2025

Yellow = active, blue = inactive, grey = no reading

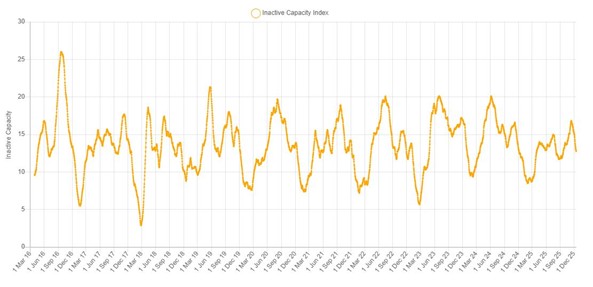

In February’s ‘Dr Copper’s Smelter-nomics’, we turned our attention to the repeatable patterns of industry behaviours that only users of the SAVANT platform have been able to surface since monitoring began in 2016. Here we highlighted the seasonal differences in smelting activity between China and the Rest of World that are consistent with the rhythms of economic activity through the calendar year. Indeed, this was a theme that the Financial Times picked up in their article ‘US copper tariffs risk widening China’s lead in metals processing’, republishing our data to support their narrative.

Chart 2: China and RoW smelting activity from the Financial Times, August 5th 2025

Following hot on the heels of its publication, we predicted that 2025 would in fact be the exception that proved the rule when looking at typical behaviours, as smelters in China would buck the trend that usually sees them ease off the throttle into year end, in order to extract better terms in annual benchmark treatment and refining charge (‘TC/RC’) negotiations with miners. Revisiting ‘Chinese smelters and the annual benchmark: why this time IS different’, we can see that we were (sic. more than?) half right. What happened in the event was that many operators – regardless of jurisdiction – chose to keep the pedal to the metal, supported by rising copper, by-product precious metal and sulphuric acid prices, so that the peak in the global inactive capacity index was much shallower – and later – than usual:

Chart 3: SAVANT Global Inactive Capacity Index, Mar 2016 – Present

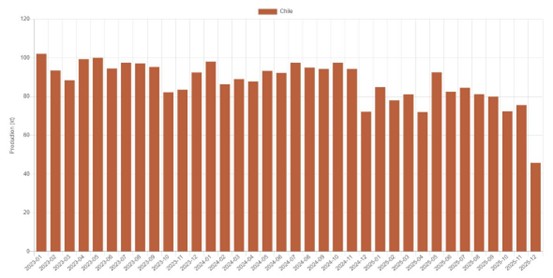

Back to March and we weighed in with the self-explanatory ‘Would tariffs revive the US copper industry?’, opining that the restart of the Hayden smelter would represent the best opportunity of a quick win for the Trump administration as it looked to reduce US dependence on imports following the launch of a Section 232 investigation. However, despite the eventual imposition of tariffs on semi-finished products in August, that has seen global copper flows diverted to the US to take advantage of the price arbitrage to the LME, news – and activity – from the Arizona-based facility has been conspicuous by its absence. But that is not to say there have not been winners from the legislation – indeed it could be argued that with smelters seeking record cathode premiums into both the European and Chinese markets for 2026, South American plants have been the primary beneficiaries (or at least those that are still operating, for as SAVANT’s copper production in beta shows [see Chart 4], Chilean output has been falling consistently for the last 2 years). Gracias Mr. Trump!

Chart 4: SAVANT Chilean copper production beta, Jan 2023 – Present

Into the lazy days of summer we put a number of smelters under the microscope in ‘Taking (copper) stock – The Good, the Bad and the Ugly’, including Mount Isa, pointing out that due to the eponymous Isasmelt technology employed, that sees a high copper loss to slag in the initial smelting process, the plant was not benefitting from rising prices to the same extent as others. And with TC/RCs still deep in negative territory at a moment when the smelter was transitioning to third party feed with the closure of the associated mine, this would put the operation in a precarious position.

At least for the time being the plant has avoided the axe following news in October of a 3-year, US$395m bailout by the Australian federal government. However, we stand by our relatively obvious opinion that ‘the smelters that are most likely to come under pressure are those in locations with high energy costs, remote from regions of strong demand growth and/or access to scrap’. The technology theme was one we revisited in October for our final missive ‘All that glitters – but it’s not gold’, examining the inherent advantage of newer smelters in China using the Shuikoushan Smelter Technology (‘SKS’) process with its high recovery of precious metals, a game changer with gold at $4,000 /oz and even more importantly, silver at $77 /oz.

So soon we will bid fare thee well to 2025, another year where subscribers to the SAVANT platform haven’t had to wait until December for their presents. Enjoy the holidays because 2026 is sure to be another fascinating year with a wave of new operations potentially starting up. And just like Santa, SAVANT will be watching.

Merry Christmas.