12 September 2024 – London – Global smelting activity increased for the third consecutive month in August according to Earth-i‘s SAVANT real-time Global Copper Monitoring Index, which showed that the percentage of smelters that were inactive for the month fell by 0.1% m/m to 15.2%.

Indeed, this was the third consecutive month that the index has fallen so, while smelters have on average been less active year-to-date than in 2023, the average for July and August has shown a 1.9% rise in activity (as deduced from a fall in inactivity of 1.9%) compared to the same period in 2023.

This speaks to the peculiar dynamics in play this year following a first half in which treatment and refining charges hit record lows due to a shortage of concentrates, that in turn saw plants bring forward and/or elongate maintenance stoppages. For a full analysis of what is driving the recent reversal in trend, please see our accompanying feature article – ‘Damned if they do, damned if they don’t? The parlous predicament of custom smelters‘.

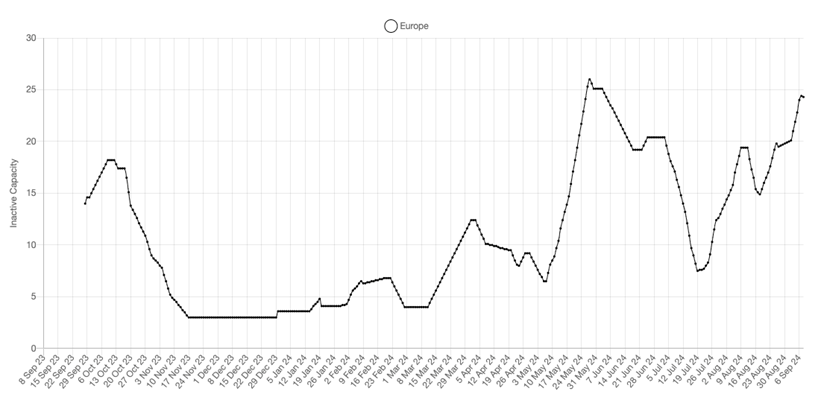

Fig I: European smelter inactivity: Jan 2024 – Present

At a regional level, the largest changes from July were seen in Europe (+7% m/m) and in Asia & Oceania (-5.5% m/m) and North America (-9.2% m/m). In the former, where despite the return of Aurubis’ Hamburg plant and uninterrupted operating profiles at Serbia Zijin Bor Copper, Ronnskar, Pirdop and Legnica, the suspension of the Glogow smelter in order to undertake a major series of works and modernisation updates was enough to push the regional inactivity index up to 19% for the month. This was not surprising as at 540 Kt/a, the plant in Poland accounts for almost a fifth of all capacity in the region.

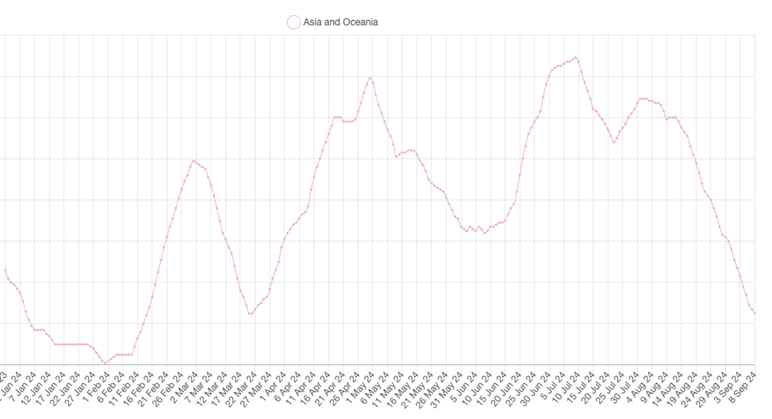

Fig II: Asia and Oceania smelter inactivity: Jan 2024 – Present

Meanwhile in Asia & Oceania the decline of the regional inactive capacity index, from an already low 12.8% to only 6.8%, spoke to a very strong operating performance for many facilities, including both Australian smelters at Olympic Dam and Mount Isa, the Japanese smelters at Onahama, Saganoseki and Tomano, while all of the smelters in Kazakhstan also displayed robust activity profiles. Indeed, it was only the relatively small 80 Kt/a Samsun smelter in Turkey that was registered offline at the beginning of the September, part of what appears to be an extended maintenance campaign.

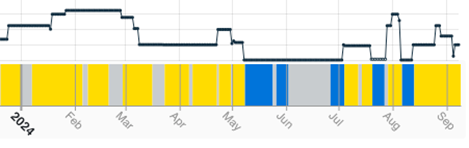

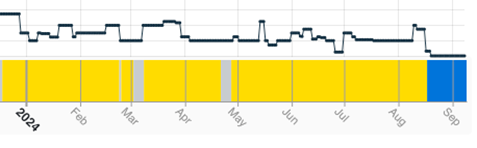

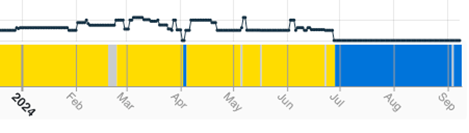

Fig III: Smelting activity, selected smelters

Hamburg, Germany

Glowgow, Poland

Samsun, Turkey

Yellow = Active / Blue = Inactive / Grey = No reading

See more about Earth-i’s SAVANT Global Copper Monitoring Index here.

About SAVANT:

Earth-i’s SAVANT platform monitors up to 95% of the smelting capacity for copper and nickel around the globe and provides indicators of smelter activity and production around the globe, in an easy-to-understand format, covering multiple metals and minerals.

Data is collected and analysed using advanced algorithms derived from Computer Vision and Machine Learning techniques. Data is taken from several different Earth Observation satellites and our global and regional indices are updated at a high frequency to give consistent, insightful and dependable results.

Activity is scientifically measured using a consistent methodology. Over eight years of historical data is available.

About Earth-i:

Earth-i is a geospatial intelligence company using machine learning, artificial intelligence and Earth Observation data to provide unique and relevant insights, derived from diverse geospatial data, that deliver clear decision advantage for businesses, governments and other organisations.

Earth-i provides advanced analytics using automated interpretation of a range of geospatial Earth Observation data sources including colour imagery, colour video, infra-red and radar from a range of sources including satellite, drone, aerial and ground-based sensors. This data is fused with additional data sources to extract factual understanding and generate predictive insights across a range of markets such as commodities, supply chain, agriculture, infrastructure and defence.

For more information visit:

Email: savant@earthi.co.uk / Website: www.earthi.space / LinkedIn: Earth-i