16 January 2025 – London – In our first feature article back in September last year we opined that custom smelters, namely those purchasing their concentrate feed from third parties, were being forced into a situation where they would be ‘damned if they do, damned if they don’t’ when it came to operating rates in 2025.

‘It does not matter if the cat is black or white, as long as it catches mice’ Deng Xiaoping

Either they could act collectively and cut production to try and derive a better outcome from the annual benchmark negotiations for treatment and refining charges (‘TC/RCs’), but risk being uneconomic due to low utilisation rates, or they could go it alone and increase activity to try and reduce unit costs, but in so-doing drive down market TC/RCs as well as undermining revenues from the cathode premium and free metal. Fast forward four months and the choice they made is abundantly clear.

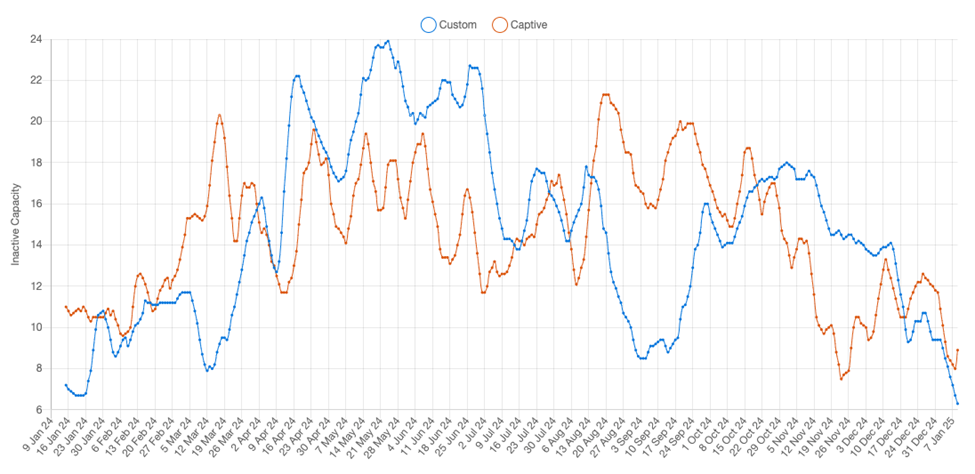

Chart 1: SAVANT inactivity indices, custom and captive smelters, Jan 2024 – Present

Following a period in September and October when smelters in China, where over three-quarters of total operating capacity is classified as ‘custom’, appeared to heed the call from the China Smelter Purchasing Team (CSPT) for production cuts and maintenance extensions (see chart 2), inactivity has decreased by nearly 12%, seemingly in complete disregard of market conditions.

Why would they do this, apparently instituting a self-destructive race to the bottom? Well, the clue here is in the word ‘self-destructive’ which should probably come with a (sic.) before it. The mere fact that the Chinese smelters negotiate as a team under the auspices of the CSPT gives a clue to the degree of cooperation between predominately state owned operators. Indeed, only a fortnight ago the CSPT approved the addition of Minmetals Copper (Hunan Nonferrous Metals), Baotou Huading Copper and Yunnan Tin as new members, adding another 300 kT/a of annual smelting capacity to the collective.

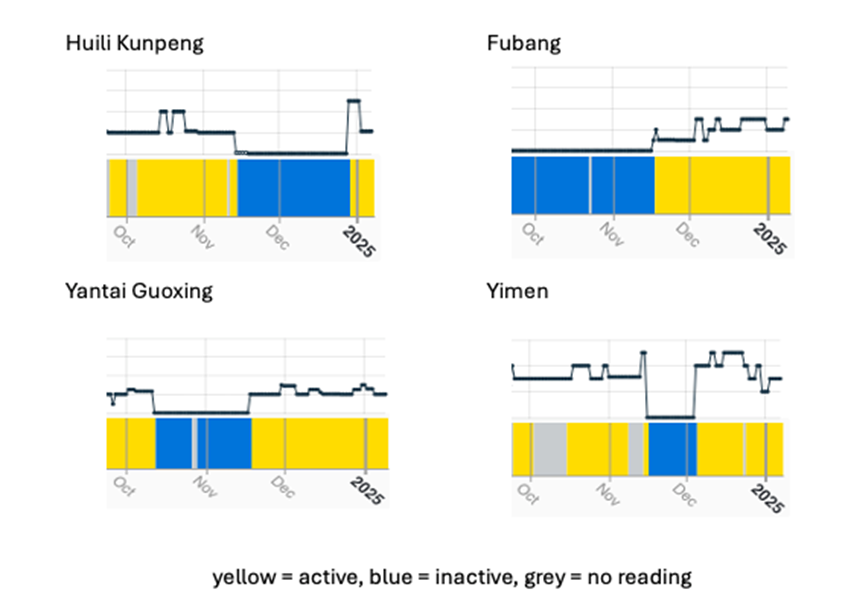

Chart 2: SAVANT inactivity observations Q4 2024, selected Chinese smelters

So with most analysts predicting that the current deficit in the concentrates market will last into the medium term, Beijing have clearly run the numbers and concluded that their own smelters are more capable of withstanding an extended period of low TC/RCs than others. And in this situation it makes sense to adopt the pragmatic economic philosophy of Chairman Deng by inflicting as much pain on those that they deem weaker, thereby forcing their demise and subsequently bringing the market back into balance sooner. Hence why the CSPT issued guidance for Q1 2025 purchases of spot concentrates at a TC/RC of only $25/2.5, following hot on the heels of Jiangxi Copper’s agreement with Antofagasta of an annual fee of $21.25/2.125 – a record low. Jiangxi were obviously acting with the implicit approval of the other members of the CSPT and by extension, the Chinese government.

For those that think this too Machiavellian, there are precedents of such behaviour in markets where China is able to exert monopoly power due to the size of its processing capacity. In the rare earths industry several years ago many noted that whenever Lynas – the only western miner of note – had a ‘bad’ quarter, domestic producer China Northern Rare Earths would reduce their prices and by proxy, that for Lynas’ material.

It begs the question, who are the mice most at risk from Deng’s cats?

This excellent article from Shanghai Metals Market (SMM) argues that the Japanese smelters have been able to negotiate better annual terms with Antofagasta than the CSPT due to their higher self-sufficiency ratio at 4-5/10 compared to China’s 2.5/10. However what the article also reveals is that with one Japanese smelter holding out for terms above $30/3, this group has likely been forced to reveal their own breakeven, exactly as the Ministry of Industry and Information Technology (MIIT) would have planned.

But in our opinion it is not the Japanese smelters that are most at risk, protected as SMM point out by their high degree of upstream integration after many years of equity investments in large mines such as Escondida, Los Bronces and Los Pelambres in Chile, Northparkes in Australia and Batu Hijau in Indonesia. Instead we see reports that Glencore is looking for buyers for its smelter at Isabel Leyte, operated by subsidiary the Philippine Associated Smelting and Refining Corporation (Pasar), as telling. This facility has been owned by the miner/trader for 25 years, however now with fewer equity-owned copper units coming from Australia with the divestment of Ernest Henry to Evolution Mining in 2022, the sale of CSA in 2023 to Metals Acquisition Corp and with the imminent closure of the Mt. Isa mine, the diminished upstream portfolio would seem unable to support both a smelter in Australia (at Mt. Isa) and in the Philippines.

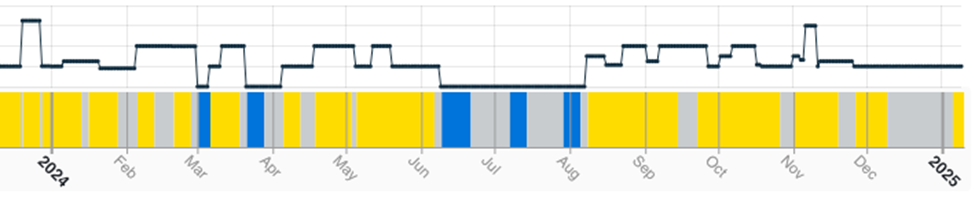

Recently, Pasar have been taking the majority of their feed from Australia and Indonesia, as well as providing an outlet for any distressed/redirected shipments from South America intended for China. However users of SAVANT will have noticed that the smelter’s 2024 operating profile was patchy, likely due to a lack of both internally available – and economic at arm’s length – feed.

Chart 3: SAVANT inactivity observations 2024, Isabel Leyte smelter

yellow = active, blue = inactive, grey = no reading

History shows that it is actually quite rare that smelters close due to market prices – Furukawa’s 120 kT/a Port Kembla in Australia was the last to do so in 2003 when TC/RCs were at similar levels to today. But until now neither have operators faced a concerted attempt to force them out of existence – allegedly.

If you would like to find out more the Copper sites above, or about SAVANT and how you can subscribe, please email savant@earthi.space or call +44 (0)333 433 0015.

About SAVANT:

Earth-i’s SAVANT platform monitors up to 95% of the smelting capacity for copper and nickel around the globe and provides indicators of smelter activity and production around the globe, in an easy-to-understand format, covering multiple metals and minerals.

Data is collected and analysed using advanced algorithms derived from Computer Vision and Machine Learning techniques. Data is taken from several different Earth Observation satellites and our global and regional indices are updated at a high frequency to give consistent, insightful and dependable results.

Activity is scientifically measured using a consistent methodology. Over eight years of historical data is available.

About Earth-i:

Earth-i is a geospatial intelligence company using machine learning, artificial intelligence and Earth Observation data to provide unique and relevant insights, derived from diverse geospatial data, that deliver clear decision advantage for businesses, governments and other organisations.

Earth-i provides advanced analytics using automated interpretation of a range of geospatial Earth Observation data sources including colour imagery, colour video, infra-red and radar from a range of sources including satellite, drone, aerial and ground-based sensors. This data is fused with additional data sources to extract factual understanding and generate predictive insights across a range of markets such as commodities, supply chain, agriculture, infrastructure and defence.

#CopperProduction #CopperSmelting #CriticalMaterials