After registering three consecutive months of declines, global smelting activity rose by 0.7% in May, in large part due to strength in China. According to data from Earth-i’s SAVANT Global Copper Monitoring Index, global inactivity fell from an average of 13.7% to 13%, despite the second quarter typically being a period when smelters choose to undertake maintenance.

While activity in the rest of world fell by 0.3%, an increase of 2.1% in China was more than enough to offset this. Indeed, in May smelting activity in China was running 11.8% above the same month last year, backing up National Bureau of Statistics (NBS) figures showing that refined copper production is at record levels, despite punitive treatment and refining charges (‘TC/RCs’).

Fig I: China inactive capacity, March 2024 – Present, 7 day moving average

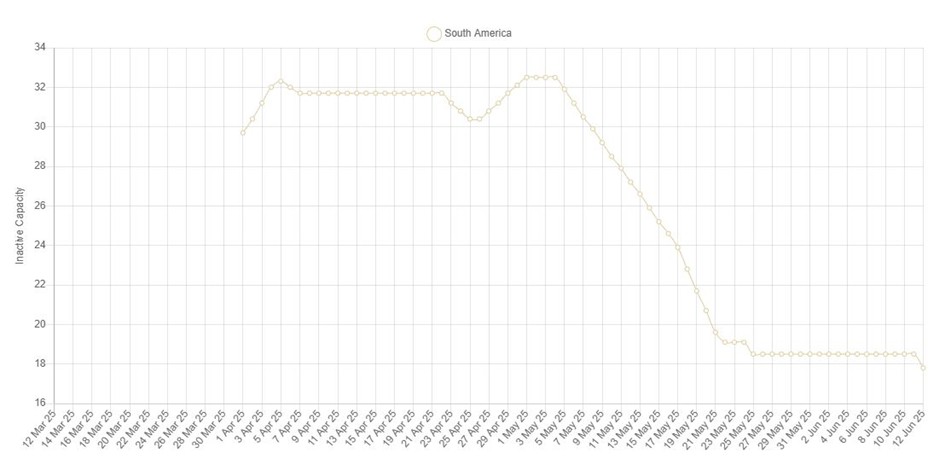

In addition, Chile, which is second only to China in terms of operating smelting capacity, also registered a sharp increase in activity, with the country level inactivity index falling by 17.6% to 9.8%. This was on the back of strong operating signals from Codelco’s 450 kT/a Chuquicamata and 400 kT/a El Teniente, as well as the continued ramp up of Glencore’s 310 kT/a Altonorte smelter following the declaration of force majeure in March. Consequently, smelting activity in the South America region as a whole increased by 12.6%.

Fig II: Chile inactive capacity, March 2025 – Present, 21 day moving average

Of the other regions, Africa once again saw significant volatility, with the continent’s inactive capacity index falling by 16.5% to 17.6%. This came as a surprise as we were expecting activity to be impacted by scheduled maintenance at FQM’s Kansanshi smelter. However, on further inspection this looks to have been delayed from initial advice that it would start in Q2, with SAVANT monitoring showing that the smelter only went offline on 5th June.

Fig III: Kansanshi smelter, July 2024 – Present

Yellow = active, blue = inactive, grey = no reading

Asia and Oceania retook the mantle of the region with the strongest smelting activity, although the inactivity series did rise by 2.1% to 8.3%, as inactivity in Europe rose by as much as 18% to 22.4%. This was primarily due to a lack of detected operating signals at Aurubis’ 360 kT/a Pirdop smelter towards the end of the month, which is entering a period of scheduled maintenance until mid-July.

Fig IV: Pirdop smelter, 2025

Yellow = active, blue = inactive, grey = no reading

* all figures are m/m unless otherwise stated