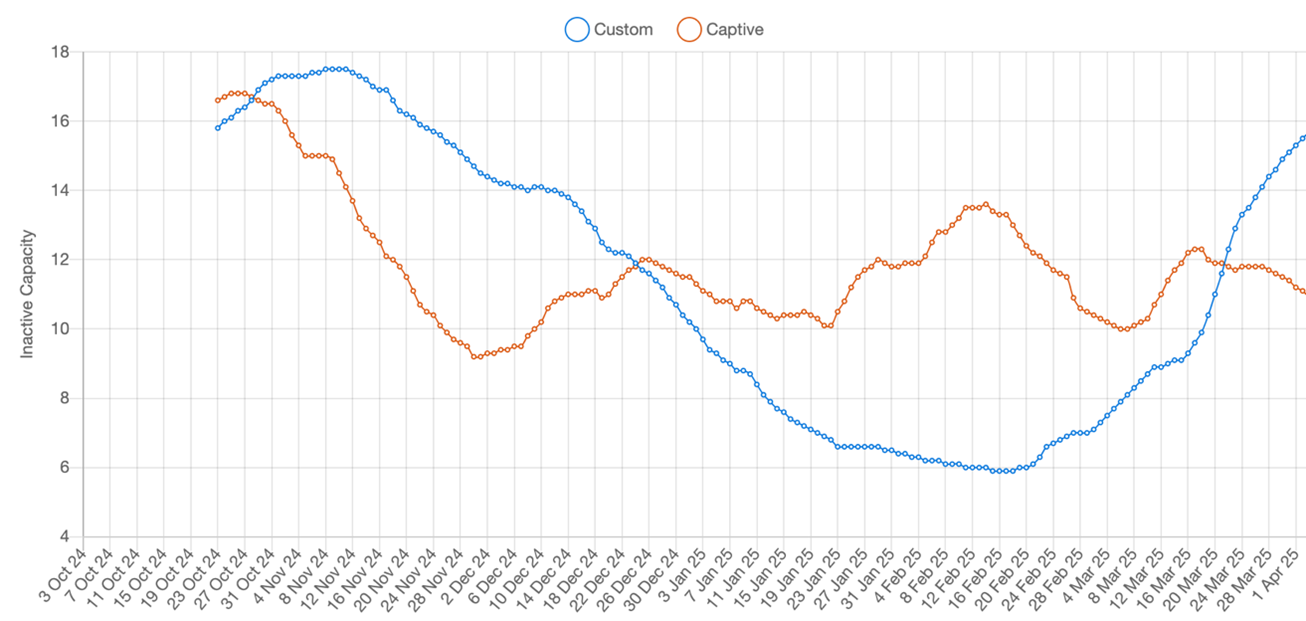

Earth-i, London 10 April 2025 – Global copper smelting activity fell in March by the largest margin since May 2023 to register its weakest reading so far in 2025, according to data from Earth-i’s SAVANT’s Global Copper Monitoring Index. With the global inactive capacity index rising from 8.8% in February to 12.6%, operators are now evidencing the response to unprecedented market conditions whereby negative treatment and refining charges, or ‘TC/RCs’, dictate that smelters are effectively paying miners for the right to process concentrates. This was best exemplified by a 6.6% fall in activity at custom smelters, plants which predominately take their raw material feed from third parties, compared to a fall of just 0.2% at captive smelters that are vertically integrated with mining assets and therefore less exposed to prevailing market terms.

Fig I: Inactivity at custom and captive smelters (21-day moving average), October 2024 – Present

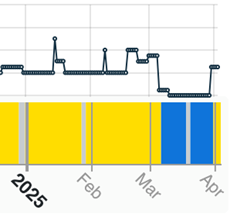

In China, the second quarter is typically when copper smelting activity falls as plants take time off for repairs and improvements. However, ‘maintenance season’ as it has become known has come early this year, with several operators choosing to take their plants offline earlier than usual in response to the dire state of the market. This has contributed to the country level inactivity capacity series rising by 4.5% to 9.6%. Notable among large plants that have seen downtime over the last month are Jinchuan & Trafigura’s 400 kT/a Jinchuan (Fangchenggang) in Guangxi and Tongling Non-Ferrous’ 200 kT/a Jinguan Ausmelt furnace in Anhui province. Nonetheless, and symptomatic of the collective approach we highlighted as a possibility in our feature article ‘Cat Theory and the Great Copper Conspiracy‘, by the end of the month of the 49 operating smelters monitored on the SAVANT platform, only 6 were showing as inactive.

Fig II: Jinguan Ausmelt smelter activity, 2025

Key: Yellow = active, blue = inactive, grey = no reading

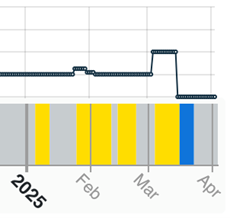

Copper smelting activity in the Rest of World also fell in March, with the inactivity capacity index rising by 3.4% to 14.9%. This was the largest single month increase since May 2023, so that smelting activity outside China is now 5% lower than in January. The well publicised closure of Glencore’s 330 kT/a Isabel Leyte smelter, where SAVANT last registered an active signal on March 15th, was a large contributor in last month’s fall in activity.

Of the regions, North America saw the largest change with the regional inactivity series, rising from 21.5% to 43.8%, as both Freeport-McMoRan’s 180 kT/a smelter at Miami in Arizona and Rio Tinto’s 320 kT/a Garfield plant in Utah showed periods where SAVANT monitoring was unable to detect operational signatures. Simultaneously, activity also fell in South America and Europe by 3.7% and 2.8% respectively, while only in Africa did activity increase, albeit by only 0.3% and coming from a relatively low base compared to other regions.

Fig III: Isabel Leyte smelter activity, 2025

Key: Yellow = active, blue = inactive, grey = no reading

* all figures are m/m unless otherwise stated