Following on from President Trump’s tariffs on semi-finished copper products imposed in August last year under the auspices of national security following a Section 232 investigation, the White House has elevated the topic of critical minerals almost to preeminence. So news earlier this month that the administration was establishing a $12 billion Critical Minerals Reserve under the moniker ‘Project Vault’ was not all that surprising. It does, however, beg the question: how well equipped the US is to ensure that ‘American business and workers are never harmed by any shortage’?

Earth-i’s SAVANT platform has been monitoring the copper and nickel industries for almost a decade now – two of the most recognisable metals on the US Geological Survey’s list of 60 minerals deemed vital to the US economy. But despite their broad application across industries ranging from deep sea cables to space rocket nozzles, US investment in both had been underwhelming before the recent commitment of around US$1.3 billion in US Export-Import Bank financing for Barrick Gold’s Reko Diq project in Pakistan.

However, financing mining projects and stockpiling raw materials does not address the strategic imperative to develop a robust, domestic supply chain that can take back control of the physical processes of industrialism – namely smelting and to a lesser degree, refining.

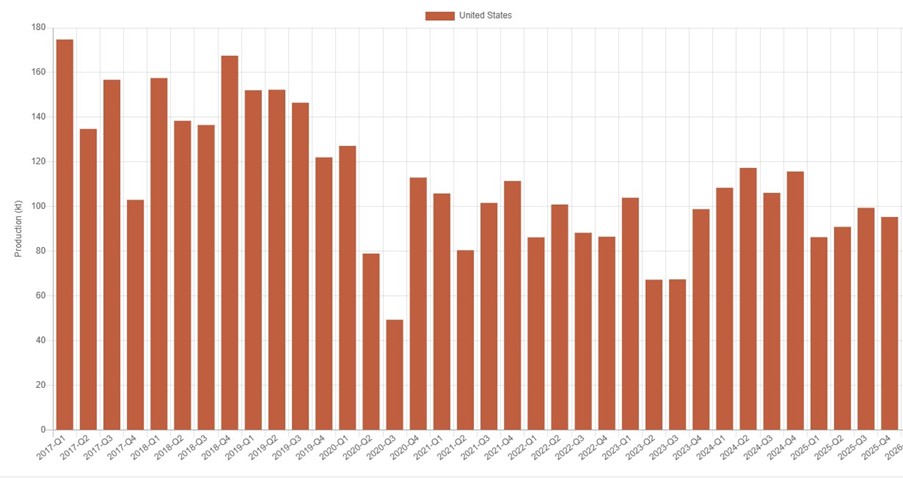

As Chart 1 shows, this is becoming increasingly necessary as according to SAVANT data, copper production in the US may have fallen by as much as a third since before the pandemic. At current levels of between 350 – 450 kt/a, the country’s dependency ratio for refined metal is therefore an unnerving 70 – 80%, despite some encouragement from tariffs to increase output at secondary smelters like Aurubis’ Richmond and Wieland’s Shelbyville.

Chart 1: SAVANT copper production in beta, USA, Q1 2017 – Present

The situation is even more dire for nickel – the US does not have a single active smelter producing any nickel metal, whether it be class I or ferronickel. As such, even if the traders who have been handed the golden ticket to procure the materials under Project Vault wanted to support US industry, they cannot. Indeed the predicament for both base metals is in sharp contrast to less obviously ubiquitous elements such as rare earths for example, where the Department of Defence’s agreement with MP Materials should allow the country’s only existing mine operator of these niche minerals to overcome a checkered history and build the separating and refining capacity that will confer a truly end-to-end, mine-to-magnet solution.

So why is the White House ignoring processing capacity for these essential energy transition metals while paradoxically pursuing trade policies that penalise the import of products further downstream that are one of few options to redress the shortfall?

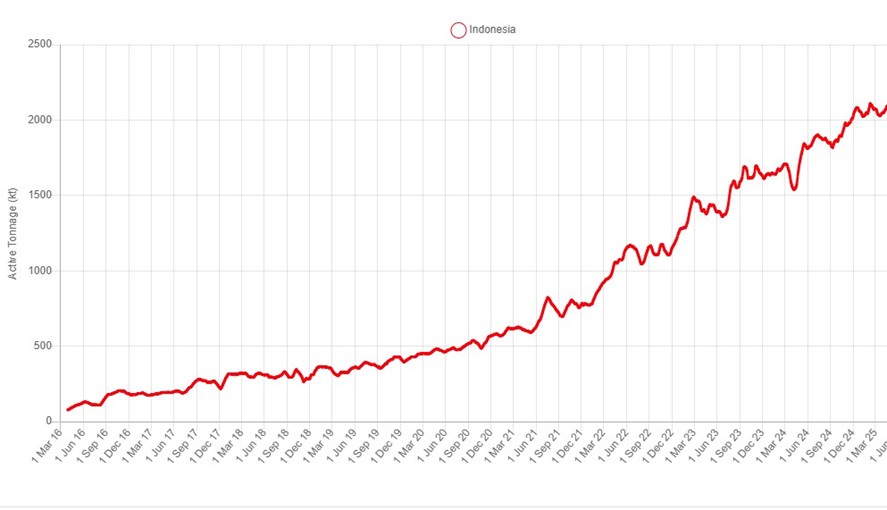

This cannot be put down to a willingness to preserve western environmental regimes, for the current administration has made little secret that it has no time for such matters. Nonetheless, matters of Environmental, Social and Governance (ESG) will have an impact as re-industrialisation in the US would come at a higher price and take longer than in jurisdictions like China, even if the latter is (finally) cleaning up its act. And processing capacity is already expensive – PT Smelting’s 342 kt/a Gresik smelter in Indonesia cost US$3.7 billion. Meanwhile estimates for PT Virtue Dragon’s eponymous 120kt/a nickel pig iron industrial and port complex in Southeast Sulawesi are anywhere up to US$5 billion for one of the key assets that propelled active tonnage in the Southeast Asian archipelago to more than 2 Mt/a in 2025. But for the White House, if the deal is right money appears no object at present, so it can’t be a question of dollars and cents.

Chart 2: SAVANT active tonnage in Indonesia, 2016 – 2025

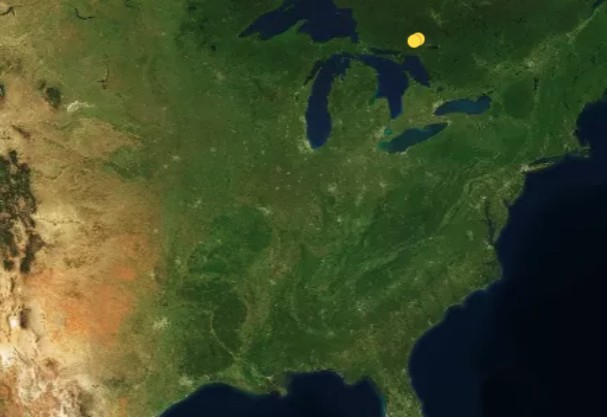

It could be the assumption that the US will be able to rely on its allies to act as toll processors of stockpiled materials. However, following the economic nationalism of this administration’s first year in office, relationships with countries such as Canada and several European nations are not as resolute as they were. The US has become increasingly reliant in recent decades on nickel imports from Canada (see Chart 3), and to a lesser extent Norway, two countries that have recently been highly vocal in their rejection of the President’s reassertion of the Monroe Doctrine.

Chart 3: Location of Sudbury Copper Cliff and Sudbury INO smelters, Canada

As Craig Tindale points out in his recent treatise ‘Critical Materials, a Strategic Analysis’ that has gone viral, abdicating the responsibility of striving for processing sovereignty reinforces what users of the SAVANT platform already know ‘the midstream functions as a global sensor network. Processors see order volumes, timing and product mix in real-time. The West must develop its own material intelligence, surveillance and reconnaissance discipline’.

For the US, the current lack of visibility is very real due to its own capacity deficiency. And now this purblindedness threatens to extend to nations that – under the rules-based global order – would once have provided insight.

The Crude Oil Reserve works because the US possesses refining hubs in Texas and Louisiana together with a comprehensive pipeline network so that it can crack hydrocarbons and move products to its regional markets. For most critical minerals, this does not exist. It might not quite be the new ‘Zinc Trap’, but could yet prove a critical oversight in the administration’s critical minerals strategy.