COPPER & NICKEL GLOBAL SMELTING ACTIVITIES STEADY IN DECEMBER

SW CHINA SEES MARKED REDUCED ACTIVITY IN COPPER SMELTING

07 December 2022 – SAVANT, the unique geo-spatial analytics product launched in October 2019 by Earth-i and Marex, covers global smelting activity for both Copper and Nickel.

Sign-up here for the Free SAVANT service.

December 2021 Copper observations include:

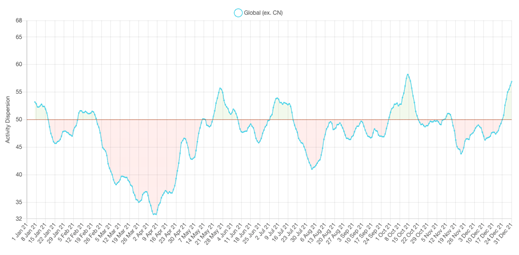

Global smelting activity was steady in December as a fall in China was mostly offset by gains in North America and Asia & Oceania. However, the headline China country level figure masks some noteworthy regional differences, with the Activity Dispersion Indices for the East and Northeast finishing the month above a reading of 55, while that for the Southwest had fallen to 35.6 by December 31st. So far there is little evidence of any ‘ramping down’ in the copper smelting industry ahead of the Winter Olympics next month. That all regions recorded Activity Dispersion readings below the average of 50 for 2021, as a whole, should not necessarily be attributed to the global power crisis, with only South America experiencing noticeably weaker activity in the last quarter of the year.

- Global Dispersion Index remained steady at 51.6, down slightly from November’s 51.7

- A fall in the China Dispersion Index from 57.4 in November to 53.5 last month was offset by strength in RoW, where the index rose back above 50 to 50.3 from 47.8 in November

- Global Inactive Capacity Index fell to 13.1, the lowest reading since January 2021

- For the full year, 2021 saw the China Inactive Capacity Index register its lowest value on record at 8.8, beating 2020’s 9.4

- In 2021 all five regions recorded Activity Dispersion Indices below 50, with South America recording a Q4 average of only 39.5

December 2021 Nickel observations include:

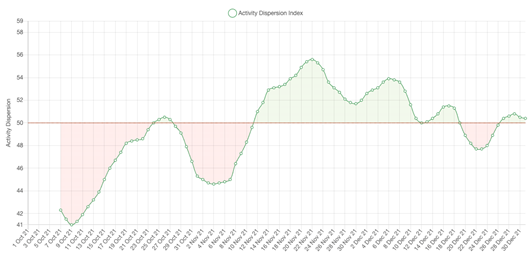

Positive demand dynamics saw the Global Dispersion Index remain above 50 in December, despite indications from nickel ore stocks at Chinese ports that purchasing may be slowing ahead of Chinese New Year as some plants undertake maintenance in January. While activity looks to have resumed at NewCo Ferronikeli’s smelter in Kosovo in recent days, this has not been enough to support the Europe & Africa Activity Dispersion Index, which fell back to 35.0 on December 31st following news of an explosion at Boliden’s Harjavalta plant. On December 20th Savant registered first activity from PT Gunbuster Nickel Industry’s $2.7Bn smelter in Indonesia. Once all 52 lines are commissioned, the facility will have a capacity of 1.8Mt of nickel pig iron/ferronickel.

- Global Dispersion Index fell back to 50.7, from 51.4 in November

- NPI Dispersion Index in China climbed to 46.1 from 42.0 in November, continuing the recovery from the power crunch that saw the index fall to 33.0 in October

- Europe & Africa Dispersion Index fell back to average 52.5 in the last month of 2021 from 64.0 in November

- NPI Dispersion Index in Indonesia rose to 55.5 in December, the highest reading since April, with first activity detected at the giant PT Gunbuster industrial complex

* – Index values go back to March 2016

Dr Guy Wolf, Marex’s Global Head of Analytics, commented: “With the commissioning of Zijin Mining’s new Qulong mine – as well as the ramp up of the company’s international upstream assets – we will be monitoring the China Inactive Capacity Index closely to see if it continues to fall in 2022. The supply chain integration recently highlighted in the raw materials development strategy under the 14th Five Year Plan from 2021-2025 is well underway in the copper industry and further consolidation will be sure to influence concentrate treatment and refining charges in the international market.”

The Activity Dispersion Index is a measure of capacity-weighted activity levels observed at smelter sites where a reading of 50 indicates that current activity levels are at average levels. Readings above or below 50 indicate greater or lesser activity levels than average, respectively. The above chart displays these readings as a weekly rolling average.

The Inactive Capacity Index is derived from binary observations of a smelter’s operational status as being either active or inactive. The capacity weighted global and regional indices show the percentage of smelter capacity that is inactive, with readings displayed in the chart below as a weekly rolling average. A reading of zero would indicate 100% smelting capacity.

The SAVANT platform monitors up to 90% of Copper and 96% of Nickel smelting capacity around the globe. Using daily updated sources, including extensive use of geospatial data collected from satellites, the index reports on the activities at the world’s smelting plants offering subscribers unprecedented levels of coverage, accuracy and reliability. This dataset allows users to make better informed and more timely trading decisions.

To find out more please visit SAVANT, or sign-up for the Free SAVANT service.

About Earth-i

Earth-i is a geospatial intelligence company using machine learning, artificial intelligence and Earth Observation data to provide unique and relevant insights, derived from diverse geospatial data, that deliver clear decision advantage for businesses, governments and other organisations.

Earth-i provides advanced analytics using automated interpretation of a range of geospatial Earth Observation data sources including colour imagery, colour video, infra-red and radar from a range of sources including satellite, drone, aerial and ground-based sensors. This data is fused with additional data sources to extract factual understanding and generate predictive insights across a range of markets such as commodities, supply chain, agriculture, infrastructure and defence.

For more information visit:

- Website: www.earthi.space

- LinkedIn: Earth-i

- Twitter: @Earthi_

To find out more please visit www.earthi.space.

For more information about this press release, please contact: info@earthi.co.uk

About Marex

Marex is a technology-enabled provider of essential liquidity and associated market infrastructure to participants in global energy, metals, agricultural and financial markets.

The Group provides comprehensive breadth and depth of coverage across four core services: Market Making, Commercial Hedging (both on exchange execution and clearing, and OTC derivatives), Price Discovery and Data & Advisory. It has a leading franchise in many major metals, energy and agricultural products, executing around 35 million trades and clearing over 175 million contracts in 2020. The Group provides access to the world’s major commodity markets, covering a broad range of clients that include some of the largest commodity producers, consumers and traders, banks, hedge funds and asset managers.

Marex was established in 2005 but traces its roots in the commodity markets back almost 100 years. Headquartered in London with 19 offices worldwide, the Group has approximately 1,000 employees across Europe, Asia and America.

For more information visit www.marex.com.