Nickel smelting extends rally as Southeast Asian NPI output lifts global activity

Global nickel smelting activity increased by 0.2% in May as output across most regions and categories of metal improved month-on-month. According to data from Earth-i’s SAVANT Global Nickel Monitoring Index, global inactivity fell from 12.6% to 12.4%. Most importantly for a market that is currently experiencing significant oversupply due to the commissioning of new capacity in SE Asia, activity at nickel pig iron (NPI) plants in both Indonesia and China increased, by 3.3% and 0.1% respectively.

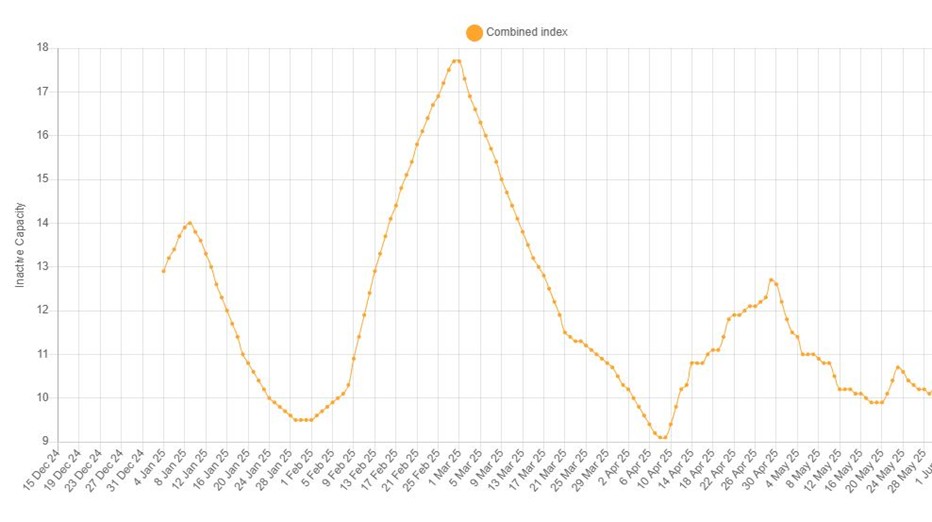

Fig I: Indonesia & China NPI combined inactive capacity, December 2024 – Present

In Indonesia, the country level inactive capacity series fell to 6.8% despite news that Tsingshan, the world’s largest producer of stainless steel, has halted production at some lines in the Morowali Industrial Park. Indeed, SAVANT monitoring would suggest that those affected are likely to be the 8 rotary kiln electric furnace (RKEF) lines at the GCNS smelter as well as the 4 RKEFs at the SMI plant.

Nevertheless, SAVANT monitoring indicates that average global NPI smelting activity for May was at its highest level since October 2024. Meanwhile activity at sites producing class 1 nickel fell by 2.4%, although with an average inactivity of only 7.2% for the month, this remains the most active of the three grades. Although activity at sites producing ferronickel increased by 1.8%, an inactivity reading of 33.6% is testament to the ongoing challenges this segment of the industry faces in competition with NPI.

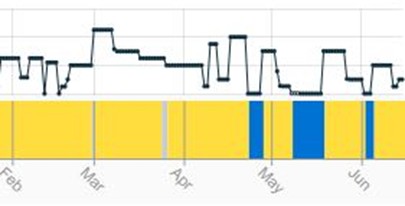

Linked to the troubles in the ferronickel industry, inactivity remains elevated in Europe at 54.4%, unchanged from April. In the Americas inactivity rose by 8.2% to 36.8% as both the Sudbury INO and Sudbury Copper Cliff smelters showed patchy operating profiles over the month. Africa and Asia & Oceania remain the regions displaying the lowest levels of inactivity at 5.7% and 5.2% respectively, although this is at least partially due to the smaller sample size compared with other regions.

Fig II: Sudbury Copper Cliff smelter activity, February 2025 – Present

* all figures are m/m unless otherwise stated